Dealing with volatile EBITDA-levels in company Valuations: (Dynamic) earn-outs in Private Equity

This article is part of a series of short LinkedIn blogs by the Food & Agri team of Anders Invest. Here we outline our perspectives on key themes that are relevant to the Food & Agri sector and explain how we try to make an impact with our portfolio companies and investment strategies.

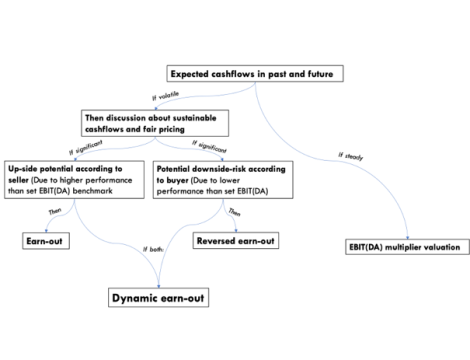

In fast-paced markets with heightened uncertainty, accurately forecasting returns and valuing companies has become increasingly challenging. In a stable market environment with a steady EBITDA, valuing a company is often more straightforward—a multiplication of EBITDA by a fair multiple often provides the answer. However, when faced with an uncertain market environment and fluctuating EBITDA due to macro events like COVID-19 or geopolitical conflicts such as the war in Ukraine, accurately determining a company's value becomes more complex. We would like to outline a dynamic earn-out structure that we employ to deal with the abovementioned dilemmas. A creative deal structure that caps both upside potential and downside risk assuring a fair price for the seller and buyer.

Let’s delve into the story of EcoBite, a fictitious company dedicated to delivering organic foods that serves as a dummy for an Anders Invest acquisition. During COVID-19, EcoBite’s performance increased substantially due to home-delivery demand. The company had an EBITDA of €6M in both 2020 and 2021. However, due to inflation and other macro-economic events, the company faced issues from both demand and supply side. This resulted in an EBITDA of only €3M in 2022. These unanticipated fluctuations in performance prompted EcoBite and Anders Invest to reevaluate their strategies and investments decisions.

The owner of EcoBite valued the company using a €6M EBITDA claiming that the lower result was an isolated event and that would soon jump to 2020/21 levels. From our perspective, the uncertainty was too high, and we claimed a valuation based on €3 million EBITDA when looking at the performance of 2022. Realistically, the fair valuation lies somewhere between these numbers, but future performance is difficult to predict and sustainable cashflows cannot be assumed.

As a result, we established a valuation benchmark at €3.5M, positioned between the specified numbers. To address the possibility of increased performance beyond the €3.5M EBITDA benchmark for the seller, the earn-out agreement enables additional returns if the results surpass this benchmark over the next three years (starting from 2023). In that case, we will pay the difference between the benchmark EBITDA and the actual realized EBITDA. This mechanism helps to capture the upside potential for the seller when performance is high.

However, to address the possibility of lower performance than the €3.5M EBITDA benchmark and mitigate potential downside risk, the structure safeguards us by granting additional shares of the company or a cash pay-back. This type of earn-out is referred to as a dynamic earn-out. This way, we can still promise our investors a fairly predictable return since both the downside risk and upward potential are partly capped. Even if there is high uncertainty and it is difficult to predict future cash flows, this arrangement allows us to keep doing fair transactions for both the seller and our investors in a volatile and uncertain market. A creative structure that is beneficial for all parties involved.

*In the past, we have successfully implemented this structure in real-life situations, customizing it to align with the distinct requirements and preferences of the selling shareholders. This framework offers the flexibility to opt for either a cash earn-out or a share redistribution. Additionally, it provides multiple payout and share redistribution scenarios that are contingent on the future performance of the company.