Anders Invest acquires interest in Solex

Anders Invest and its Mosman co-shareholders have a controlling interest in Solex Thermal Science Inc. acquired. Based in Calgary, Canada, Solex, like Mosman, is active in the production and sale of indirect bulk heat exchangers. The expertise of Solex and Mosman are combined so that they can achieve optimal performance for their customers.

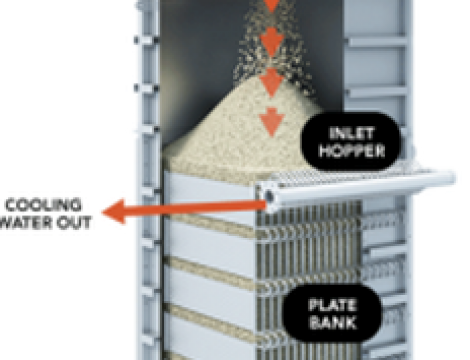

Solex is a world leader in the development and sale of indirect heat exchangers for bulk bulk goods. In addition to the application in production processes of sugar, oilseeds and fertilizers, Solex has developed heat exchangers for a wide range of other production processes, for example for coffee beans, casting sand and energy storage media. The company has extensive expertise in product development and has a worldwide active sales team.

In its 25-year history, Solex has maintained its position as the market leader in bulk bulk heat exchangers. Due to the increasing attention to energy consumption of the production processes and the desired high quality and consistency of product output, indirect heat exchangers are being used in more and more production processes. In recent years, Solex has invested heavily in the development of its technology for applications in a wide range of bulk bulk materials.

Solex and Mosman will join forces to offer their customers optimal solutions. The locations in Calgary Canada and Haaksbergen Netherlands remain active and the combination of capacity enables Solex and Mosman to better serve their customers with products and services. As a result of the combination of the companies, the production of the heat exchangers will be concentrated in the Mosman facility in Haaksbergen and it is expected that this production location will be expanded.