Filter: industry real estate Food & Agri

Anders Invest invests in Genap Anders Invest has acquired a 49% stake in Genap, based in ’s-Heerenberg. Genap delivers custom-made liner and water storage systems for horticulture, agriculture and civil engineering and infrastructure (GWW). The company generates annual revenue of approximately €25 million and employs over 100 people. For decades, Genap has been a leading player in the field of water and liquid storage. From its headquarters and main production facility in ’s-Heerenberg, and its second production location in Steenwijk, the company develops high-quality liner solutions used worldwide. These range from water silos and basins for greenhouse horticulture to sealing solutions for large-scale infrastructure projects and manure storage systems in the agricultural sector. Genap’s strength lies in the combination of in-house material processing, craftsmanship and deep technical expertise. Plastics such as HDPE and LLDPE are processed internally and extensively tested in the laboratory, where R&D and certified welding processes ensure consistent and verifiable quality. Within the civil engineering and infrastructure sector, Genap works on major projects, from roads and tunnels to the sealing of landfills. The company installs large areas of waterproof geomembranes, sometimes more than 100,000 m² per project. Genap particularly distinguishes itself through a capability mastered by only a few parties: the skilled installation of these waterproof layers in wet conditions. Genap supplies and installs its systems worldwide, supported by a network of its own locations and partners. For the international horticulture market, the company has local production and installation capabilities in, among others, Canada and Mexico. This keeps lead times short and enables projects in those regions to be managed directly and efficiently. In the agricultural sector, Genap has been providing reliable manure storage systems for decades. These solutions align with increasingly stringent regulations and play an important role in reducing odor and CO2 emissions. Dick van Regteren will remain in place as CEO and shareholder. With Anders Invest’s participation, Genap will focus on further professionalizing the organization, expanding international production capacity, and continuing to develop solutions for water and manure storage and liner systems for the civil engineering and infrastructure sector.

08 january 2026

Anders Invest invests in Falkom Anders Invest has acquired a 40% stake in Falkom B.V., a manufacturer of recovery vehicles based in Tiel. The company generates annual revenue of €20 to €25 million and employs nearly 100 people. Founded in 1983 and headquartered in Tiel, Falkom designs and builds recovery vehicles for cars and trucks. The company has developed into an international player with a broad product portfolio and supplies customers through a network of dealers and direct relationships across Europe and beyond. Production takes place in the Netherlands and Poland. Falkom offers a complete range of vehicles that combine maximum operational capacity with a lightweight design. Thanks to its capabilities in electronics, hydraulics and mechanics, the company can integrate truck beds, cranes and tool cabinets onto a wide range of truck chassis. Innovative designs provide optimal storage space and a high-quality finish, ensuring customers receive vehicles that are not only functional but also visually appealing. Falkom will retain a strong management team with a proven track record of growth. Managing Director Evert van de Glind, who has been responsible for day-to-day management since 2015, will retain a 50% shareholding. Ties Aalbers, who has long been responsible for operations, will acquire a 10% stake. Under the leadership of Evert, Ties and the wider Falkom team, the company has tripled its revenue over the past ten years and has grown into one of the international market leaders. With Anders Invest’s participation, Falkom can further realize its long-term growth ambitions. The company will remain focused on innovation, customer orientation and productivity.

08 january 2026

Anders Invest has acquired a stake in Straatman Anders Invest has acquired a 51% stake in Straatman, a manufacturer of balcony railings and balustrades from Varsseveld. The company has an annual turnover of €20 to €25 million and employs nearly 100 people. Straatman Building Smart Connections, founded in 1991, specializes in balustrades and stairs for apartment complexes. The Varsseveld-based company designs, manufactures, and installs customized solutions in series that combine safety, innovation, and visual appeal. By digitizing and automating every step in the process as much as possible, from 3D engineering to production, the company succeeds in realizing tightly managed construction processes with short installation times on site. This expertise makes the company particularly strong in apartment complexes where large quantities and varieties must be built within a short timeframe. Since 2017, turnover has tripled and the company has increased its market share, particularly with large Dutch construction companies. Anders Invest holds a 51% stake alongside the two existing shareholders. Albert ten Wolde (59), involved with Straatman since 1999, is the driving force behind innovation and product development. Bart Peters (39) joined the company in 2006 as a project engineer and subsequently held various key roles within the company. He excels at optimizing processes and strengthening teams and will take on the role of Managing Director. Together, Albert and Bart combine innovative strength with a sharp focus on scalability and productivity. Anders Invest's participation will enable the company to continue fulfilling its growth ambitions in the long term.

17 november 2025

AIFMD license Anders Invest is pleased to announce that it received a license from the Netherlands Authority for the Financial Markets (AFM) under the Alternative Investment Fund Managers Directive (AIFMD) on September 25, 2025. With this license, we are officially recognized as an alternative investment fund manager and comply with strict European regulations on transparency, risk management, and investor protection. This license allows us to further develop existing funds and launch new investment funds. Anders Invest currently manages six active funds with total invested capital of nearly EUR 600 million, raised by approximately 900 investors. We are proud of this step and look forward to continuing to build long-term relationships with our investors within this regulated framework.

16 october 2025

Update advisory board Industry Fund Anders Invest Industrie Fonds announces several changes in the composition of the Advisory Board and fund management. After eight years of involvement, Frederik van Beuningen is stepping down as chairman of the Advisory Board due to age. He will be succeeded by current board member Herman Spliethoff. We are very pleased that current member Henk Willem van Dorp wants to complete his third term. In addition, Jan de Wilde will be added as a new member of the Advisory Board. In fund management, Rutger de Vos is transferring his tasks to Gerald van Kooten, so that Rutger can focus more on the portfolio companies. Advisory Board Frederik van Beuningen has played an important role in the growth and professionalization of Anders Invest Industriefonds. As co-founder of Teslin and with broad experience in long-term investments and entrepreneurship, he has used his expertise and network to take the fund to a higher level and to represent the interests of investors in fund management. We thank him for his leadership, dedication and commitment in recent years. Herman Spliethoff will take over the chairmanship. He has extensive experience as an investor, management consultant, entrepreneur and supervisor. He has been co-owner of the Amsterdam shipping company Spliethoff for decades. He gained extensive experience at private equity firms through a management role at QAT Investments and a supervisory role at TBL Mirror Fund. Herman has been involved in the Advisory Board since the establishment of the Industriefonds and thus plays a role in the course and development of the fund. The fund management has always appreciated his level of preparation and substantive input and is pleased that he will take on the role of chairman. Jan de Wilde (1977) will join the Advisory Board as a new member. Jan was a partner at Nielen Schuman for 20 years, almost from the start of this renowned consultancy firm. In this leading role, he developed into a specialist in M&A transactions for family and founder companies and private equity funds based in the Benelux. He is now an enterprising private investor (also with Anders Invest for several years) and advisor with expertise in mergers and acquisitions and capital structures. With his experience, he will advise the fund management on the further professionalization of investment processes. Fund management Rutger de Vos, one of the founding partners of Anders Invest, has worked as a fund manager of the Industrial Fund in addition to his role as investment manager in recent years. His affinity lies mainly with the portfolio companies with the strategic and operational challenges that the manufacturing industry faces. He has therefore decided to focus exclusively on actively supporting the portfolio companies in their growth and strategy from now on. Anders Invest is particularly grateful to him for the commitment and dedication with which he has shaped the team and the fund. Gerald van Kooten will take over the role of fund manager. Like Rutger, Gerald has been involved with Anders Invest since the start and focuses mainly on acquisitions. This remains his main activity. In close cooperation with the other fund partners, he also takes responsibility for the fund management. Gerald will provide information to industrial fund investors, together with Gert-Jan Huisman, who is responsible for investor relations as managing partner and also supports two large industrial companies. Both will play an active role at the members' meetings. With these changes, the Anders Invest Industrie Fonds will continue to support and grow industrial companies in the Netherlands and abroad. We thank all those involved for their efforts and look forward to a successful continuation of our activities under the new composition of the team.

27 february 2025

Acquisition Spaans Babcock Anders Invest has acquired screw pump manufacturer Spaans Babcock from Balk. The company has an annual turnover of €20 to €25 million and employs over 100 people. Spaans Babcock engineers, produces, builds and installs screw pumps, screw generators, grids and aeration for wastewater treatment plants, pumping stations and hydroelectric power plants. The company is over 125 years old and was founded in 1897 by the Spaans family. In 1974, the company became part of the FKI Group Ltd., which also had a Babcock company in its group, and the current company name was created. In 1995, the company was acquired by the Alpha Group International. The company realises the majority of its turnover with screw pumps, aerators and hydro turbines, in which niche the company is the global market leader. A large production location is located in Balk where the screw pumps are produced using CNC-controlled machines and welding robots. The screw pump distinguishes itself from other pumping techniques because of its capacity, lifespan, insensitivity to contaminated liquids and energy efficiency. In addition, the screw is fish-friendly and maintains the biological balance in purification plants because the pump has no destructive effect on the composition of the liquid. In addition to the branch in Balk, there are branches in England and Canada/United States. The end customers are generally (waste) water purification companies, water boards (for example polder pumping stations) and companies active in the construction or operation of sewage treatment. With its own sales offices in England (Heywood) and Canada (Ontario), Spaans Babcock supplies its products worldwide. The shares in Spaans Babcock were acquired from Alpha Group International. The Alpha Group is an investment vehicle of Mr. Nolst Trenité and Mr. Eijt. Mr. Eijt is general manager at Spaans Babcock and will remain as general manager and shareholder.

02 september 2024

Investment in HTC Group Anders Invest has acquired a minority stake in HTC Group from Waddinxveen. HTC is the Dutch market leader in speed gates and employs over 80 people. HTC is known for its high-quality products and innovative custom solutions. For example, the company has introduced mobile speed gates for temporary applications and produces speed gates with safety standards up to and including RC5. HTC has developed a product-as-a-service model and is investing in sustainability by developing the circular speed gate. The company's head office is located in Waddinxveen, where the production and assembly of the speed gates also takes place. From this location, the company carries out service and maintenance work with a nationwide network. HTC has its own engineering branch for the development of its products. Sales take place from the Netherlands and through a dealer network in Europe. Its customers are parking managers, government institutions, installers and homeowners' associations. The shares in HTC were acquired from Peter Thun. In addition to Anders Invest, operational director Robert-Jan Karsman has joined as a shareholder. Peter will remain as general manager and majority shareholder.

02 september 2024

René Keulen starts as CFRO As of August 19, 2024, René Keulen has joined Anders Invest as CFRO. His arrival will enable Anders Invest to professionally fulfill its further growth ambitions. René has extensive experience in the field of fund management and, in the crucial CFRO role, will be responsible for, among other things, financial management including investor administration, internal business operations, risk management and compliance. In the past 7 years, René worked in a similar role as CFO at Orange Capital Partners, a successful investment and asset management organization with real estate funds active in four European countries. At Orange Capital Partners, he managed the process of applying for and implementing the AFM license, which will also be his responsibility at Anders Invest. Before that, he worked at Klepièrre, Schroders and EY, among others.

19 august 2024

Anders Invest Industrie Fonds acquires Motrac Industries Royal Reesink and Anders Invest have completed the acquisition of Motrac Industries. Motrac Industries Holding B.V., founded by Anders Invest, is now the owner of Motrac Hydrauliek B.V. and Motrac Hydraulik GmbH. Motrac Industries, with locations in Zutphen and Papendrecht (Netherlands) and Willich (Germany), employs 110 people and has nearly 70 years of experience in hydraulic engineering. In recent years, the company has successfully expanded into electric drives. Motrac Industries is the distributor of Linde Hydraulics in the Netherlands, Belgium, Germany, and Poland and maintains supplier relationships with leading parties. This forms the foundation for the successful development, construction, supply, and repair of hydraulic and/or electric drive systems. Additionally, under the name IMAV hydraulik, hydraulic manifolds are produced in Willich, while in Papendrecht, under the name Hydromarine, specific solutions for inland navigation are provided and maintained. Motrac Industries' systems are used worldwide in agriculture, maritime, mobile, and industrial sectors. Motrac Industries was acquired by Anders Invest, a renowned investment company focusing on long-term investments and collaborations with Dutch small and medium-sized enterprises (SMEs) in the manufacturing and technical sector. For Royal Reesink, this step aligns with the company's strategic focus on core activities; distribution and aftersales of machines for agriculture, construction, landscaping, and logistics. Motrac Industries, as a supplier of high-quality hydraulic and electrical solutions and components, does not fit into the portfolio of Royal Reesink. With the market in which Motrac Industries operates, Royal Reesink has too few points of contact and believes that another owner can better support Motrac Industries in its ambitions. Rogier van der Linde, CEO of Royal Reesink: "We are pleased with this transaction. Firstly because we believe Anders Invest is the right partner to take Motrac Industries forward and help it reach its full potential. Secondly, because it is an important step in our strategy to refine our portfolio. We thank the teams at Motrac Industries, led by directors Maarten Vinkesteijn and Nicolai Linssen, for their contributions to the development of Royal Reesink and wish them great success under the flag of Anders Invest." Maarten Vinkesteijn, division director at Reesink Industries: "With Royal Reesink as our parent, we have had the space to build the future-proof company that stands today. With a fantastic building in Zutphen, new machines in Willich, and an entirely new product group 'E-drive'. Since joining Royal Reesink in 2013, we have tripled our revenue; a growth only possible with the support of Royal Reesink. We are also grateful that Motrac Industries has been able to play a significant role in the search for a new and suitable partner. Anders Invest has expressed a strong commitment to retaining Motrac Industries' talented staff and providing opportunities for growth and development. Customers can expect a seamless transition and a continued high level of service and support from Motrac Industries." Gerald van Kooten, partner at Anders Invest: "With Motrac Industries, the Anders Invest Industry Fund has added a strong specialist with a track record in hydraulic drives and a good position in the rapidly growing market for electric drives combined with hydraulic solutions. This enables Motrac to deliver unique customer solutions in the various end markets in which they operate." About Royal Reesink: Founded in 1786 as a foundry and trading company in Zutphen, Royal Reesink is one of the oldest distribution and service companies in the world. It is a leading international distributor of agricultural, construction, landscaping, and logistics machines, with over 40 operating companies on four continents distributing machines and components for the industrial, agricultural, and landscape maintenance divisions of leading OEMs (Original Equipment Manufacturers). Thanks to our global network and local presence, customers can operate in the best possible way. In 2023, revenue exceeded 1.4 billion euros, and the company employed 2,700 people. About Anders Invest: Anders Invest invests for the long term in the Dutch industry, Food & Agri sector, and (healthcare) real estate. The Anders Invest Industry Fund focuses on companies active in the manufacturing industry with proven revenue and profit capacity. The fund has built a broad portfolio of 36 companies in this segment. The industry fund provides risk capital for both minority and majority interests. Anders Invest's approach is distinguished by its focus on long-term, sustainable value development (slow equity), practical and active management support (supportive), and a fair and transparent approach (straight).

25 july 2024

Anders Invest acquires KTK Groep from Almelo Anders Invest has acquired KTK Groep from Almelo. KTK Groep is the Dutch market leader in custom containers and press installations. The company achieves an annual turnover of €25 to €30 million and employs over 50 people. KTK Groep is known for its high-quality products and innovative custom solutions. For example, the company is the creator of the lightweight Greenline container, featuring a limited number of frames, folded walls, and the use of lighter steel types. This year, the company is launching a revolutionary concept called Vollov: a lighter and more sustainable variant of the conventional underground collection container, equipped with a steel cylinder or a waterproof bag made of technical textile. The company's headquarters are located in Almelo, where the assembly and coating of the containers also take place. At its recently acquired new location in Hattemerbroek, the company performs service and maintenance work and operates an extensive field service team of technicians who work nationwide. KTK has its own engineering and business office and outsources the production of basic containers. Additionally, the company is an importer of Husmann and Kiggen press installations. Its customers include waste processing companies, municipalities, and a wide range of industrial clients. The shares in KTK Groep were acquired from Vincent Janssen, Tonnie Touwen, and Stephan van Uitert. They will continue to lead the company and, together with Anders Invest, will further shape the growth of the business.

12 july 2024

Anders Invest Food & Agri Fund participates in Poultry Company Hillco B.V. Anders Invest Food & Agri Fund has acquired a majority stake in Hillco Poultry Company B.V. The company produces and sells chicken products for the Dutch, Belgian, and German foodservice markets. Together with the new management team – Jaap Randewijk and Dinand Heijkamp – as well as the existing Hillco team, the focus will be on further growing the business in existing and new markets. Hillco Poultry Company B.V. is a Dutch family-owned business that has specialized in processing responsible chicken products for over 40 years. Under the brand Family Chicken, Hillco offers a thoughtfully curated range of chicken products aimed at the foodservice sector. Particularly, restaurants, fast-food chains, caterers, and gas stations are among the key target groups. With a strong focus on taste, quality, stability, and clear pricing policies, Family Chicken has secured a strong position in the Dutch foodservice industry. Additionally, Hillco aims to significantly expand its own brand "Smikkelkip" in the coming years. The company has been transferred from the Van den Brink family to Anders Invest, Dinand Heijkamp, and Jaap Randewijk. The reason for this is that the Van den Brink family sees ample growth opportunities for Hillco and is seeking a suitable new owner to realize these growth opportunities. Therefore, it has been agreed that Dinand Heijkamp and Jaap Randewijk will lead the management and, together with Anders Invest, implement the growth strategy. After a transition period, the Van den Brink family will focus on other activities. Evert Hein Schuiteman, partner at Anders Invest, is pleased with the arrival of Hillco: "They are a major player in the market with a substantial turnover and solid margins. I am impressed by the high-quality products and the team's expertise in product development and sales. The market is also interesting; although meat consumption per capita is slightly declining, we see growth in the consumption of high-quality chicken snacks, especially in the foodservice channel. This inspires confidence, and we anticipate a wide range of opportunities for Hillco's positioning and strategy." Ap van den Brink, one of the sellers, says, "We are glad that we could transfer it this way. The enthusiasm and energy of Jaap, Dinand, and the whole team, together with the ambitions and professional support of Anders, provide confidence for the future. Additionally, it is our desire that the Biblical truth of Psalm 127:1 will not be forgotten in the future. Unless the Lord builds the house, the builders labor in vain. Unless the Lord watches over the city, the guards stand watch in vain." For more information: Anders Invest: http://www.andersinvest.nl/ Evert Hein Schuiteman (Partner Anders Invest food & agri fund) – +31 6 55 766 513 / Evert Hein Schuiteman ehschuiteman@andersinvest.nl Jurjen van der Werf (Investment Manager Anders Invest) - +31 6 23 80 27 83 / jvanderwerf@andersinvest.nl Hillco Poultry Company: www.hillcopoeliersbedrijf.nl

10 may 2024

Michael Advocaat joins Food & Agri Fund Anders Invest is pleased to announce that Michael Advocaat has joined the investment team of the Food & Agri Fund as a Senior Associate. Michael (1994) studied International Business Administration and Finance & Investments at the Rotterdam School of Management (RSM). After his studies, he started as an M&A consultant at boutique Mahler Corporate Finance, where he was involved in 7 closed transactions over 3 years, including for a key client in the Agri sector. Following this, Michael gained experience as CFO at IoT scale-up SODAQ (40 FTE), where he established the finance department and ERP system, raised equity & debt funding, and served as finance manager at VC-backed Joint Venture Basetime. Within Anders Invest, Michael is primarily involved in supporting acquisition processes and portfolio companies.

26 april 2024

Bart Leemans becomes co-shareholder of Service2Fruit After a year of service as director of Service2Fruit, Bart Leemans becomes a co-shareholder of our portfolio company. Service2Fruit is the online trading platform for fruit, which strives for fairness and transparency in the industry in an innovative way. Bart Leemans mentions that the idea of becoming a co-owner had been brewing for a while, and there was a good feeling and a clear vision for the future from both sides. Despite his level-headedness, there is also a sense of pride: 'I find it exciting, it signifies a level of trust and mutual commitment." "In the coming years, we will work tirelessly to expand our mission to other product categories. We truly embody this at Service2Fruit; 'always a fair deal' is still far from being the norm in most product categories. We are currently busy with the launch of the platform for potatoes and developing modern software that can easily adapt to the dynamics of the respective sector. We aim to make the trade in the fresh produce world fairer and more transparent, and we have a proven value proposition. It's time to take really big steps now; I do like to stir things up a bit."

11 april 2024

Anders Invest participates in Vanmac Group Anders Invest acquired a minority interest in Vanmac Group from Amersfoort. The company produces machines for the turf industry, green and sports field management, green management at airports and waste collection. The company has a turnover of € 15-20 million and employs approximately 60 employees. Vanmac Group finds its roots in Van Loen Techniek B.V., founded in 1932. Under the name Trilo it markets machines of its own making. Vanmac produces leaf blowers, mowing vacuum trucks, leaf vacuum trucks and (waste) suction containers. The Trilo mowing suction wagon is a unique machine that mows and vacuums grass in one and the same movement. It enables airport green managers to keep grass at an ideal height while minimizing the risk of nuisance from birds and the associated risk of 'bird strikes'. The company has production locations in Amersfoort and Vietnam and has a sales office in England. Vanmac realizes worldwide sales through direct sales and a dealer network. Anders Invest has acquired the shares in Vanmac Group from the current owners Peter van Mispelaar and Leo van Loen, who remain committed to the company as long-term shareholders. In 2027, Anders Invest will expand its interest in Vanmac to a majority of the shares. The current general manager, Christiaan Arends, also joins as a shareholder. Together with the existing management team, they will actively contribute to the growth and professionalization of the organization.

05 december 2023

GMM Food & Agri Fund On Thursday, November 16, the general meeting of the Anders Invest Food & Agri Fund took place at the portfolio company Lamboo Dried and Deco in Lisse. The 5th general meeting was held in the presence of fund members, led by Frederique de Bruin, the new chairperson of the Advisory Board. After the meeting, Francis, Jan, and Koos Lamboo provided a tour of the impressive production, storage, distribution, and sales facility in Lisse of the dried flowers and decoration company, known for its quality and reliability. During an interview conducted by Investment Director Saskia Korink, Francis and Jan spoke enthusiastically about the company's history and their reasons for partnering with Anders Invest. When the third generation Lamboo also came to check in, the picture was complete, and the gathering was very successful. Thanks to all members of the Food & Agri Fund for their presence and to the Lamboo family for their hospitality.

24 november 2023

Groku acquires Harstra Instruments Groku from Kampen has fully acquired Harstra Instruments from Zeewolde. Harstra manufacturers cleaning equipment and drying cabinets for the safety technology industry. Due to the similarity between production methods and the diversification of end markets, Harstra is an important addition to Groku. Harstra, founded in 1940, originally focused on the development and production of scientific instruments. Over time, the focus has shifted from laboratory instruments to developing and producing solutions for the safety technology industry. The company's two main products are drying cabinets and cleaning machines for cleaning air masks and equipment, which can then be dried in a range of drying cabinet models. In this niche, Harstra has a global customer base that includes fire brigades and industrial safety services. Harstra has a location in Zeewolde where the products are manufactured, assembled and tested. Groku has acquired the shares from Roland van der Ham and Jolanda Van der Ham-Gerritse. Roland took over his father's company in 1983 and Jolanda became involved with Harstra in 1996. They will transfer their work to Groku employees in the coming period. Groku will ensure to continue to deliver the quality and service level that Roland and Jolanda achieved with Harstra Instruments. Anders Invest, together with director Karl den Besten, has been a shareholder of Groku since 2018. With the addition of Harstra, it broadens both its portfolio and geographical end markets.

13 october 2023

Organic Flavour Company acquires Teamasters Organic Flavour Company (OFC), a producer of organic tea, herbs, and spices, is pleased to announce that it has acquired a 100% stake in Teamasters on September 13, 2023. This strategic acquisition enables OFC to expand its product portfolio and achieve synergies in procurement and production. Teamasters specializes in the production of premium organic tea in pyramid bags and primarily focuses on private label production. The key motive behind this strategic acquisition lies in the synergies between the two companies. These synergies extend not only to the product offering but also to procurement and production. Steven Kleinjan, founder and former owner of Teamasters, will acquire a stake in OFC and will serve as the Chief Commercial Officer (CCO) at OFC, contributing to the continued growth of both companies. "With this merger, a broader range of herbs, spices, and teas in various packaging forms can be developed and produced. As a result, we have become an even more attractive partner for private label customers," said Steven Kleinjan, founder and owner of Teamasters, and in the new situation, the Chief Commercial Officer of Organic Flavour Company. For more information, please contact: Steven Kleinjan (CCO, OFC) – +31 6 22 45 20 26 / steven@teamasters.nl Peter van de Steeg (CEO, OFC) – +31 6 12 28 64 82 / p.van.de.steeg@ofc.nl Evert Hein Schuiteman (Partner, Anders Invest) – +31 6 55 76 65 13 / ehschuiteman@andersinvest.nl

26 september 2023

Anders Invest Food & Agri fund participates in Lamboo Dried & Deco The value-driven Food & Agri Fund of Anders Invest has acquired a stake in Lamboo Dried & Deco. Lamboo was founded in 1982 by Koos Lamboo, father of the current owner and CEO Jan Lamboo. During the last 40 years, the company developed into a leading player in the dried flowers and natural decorations industry. With this cooperation, Lamboo aims to strengthen its unique position as integrator in the dried flowers supply chain and together with its partners, further achieve its international growth ambitions. The Boards of Anders Invest Food & Agri and Lamboo finalised the partnership on 20 June. For clients and suppliers of Lamboo nothing will change. Furthermore, the activities of the company will be continued under the same name. Jan Lamboo remains the CEO of Lamboo Dried & Deco. At Anders Invest, Evert Hein Schuiteman will be responsible for the support of Lamboo. Jan en Francis Lamboo: “Together with our team, we have worked on establishing a unique company and brand in the dried decorations space. Craftmanship, high quality and sustainability are the most important pillars at our company. At Lamboo Dried & Deco, we were looking for a partner that is able to help guarantee the continuity and ambitions of our company. Anders Invest Food & Agri has a long term vision and a focus on sustainability. This made them the best partner for us to cooperate with” Evert Hein Schuiteman, partner Anders Invest: “We are very proud to welcome Lamboo Dried & Deco as the eleventh investment in our portfolio. Our portfolio can be characterised by companies that produce or distribute high quality products. In that sense, Lamboo is a perfect fit for Anders Invest. Our market research confirmed that Lamboo is known worldwide for its high quality products and innovative concepts. On top of this, we are impressed with the strong foundation that has been laid by Jan and his father Koos over the past 40 years. This makes the company ready for further growth. We are looking forward to working together on achieving Lamboo’s growth ambitions in the coming years.” Rembrandt F&O en Wijn & Stael advised Lamboo and its shareholders in this transition. MA Law advised Anders Invest.

17 august 2023

Food & Agri Fund completes financing round of 25 million The Anders Invest Food & Agri Fund successfully completed a financing round recently. In this round, over 25 million euros was raised to invest in Food & Agri enterprises with approximately 10 million euros in revenue over the next 12 months. The fundraising goal for this capital round was 25 million euros, which was partially raised from existing investors, as well as from 82 new investors. We are thrilled to have introduced so many new parties to the fund alongside our existing investors and are looking forward to fruitful collaborations. The Anders Invest Food & Agri Fund has an indefinite duration and invests in companies without being driven by exit strategies, with a focus on the long term.

31 july 2023

Participation Flexxolutions On July 20, 2023, Anders Invest acquired a 75% interest in Flexxolutions from Oldenzaal. The company produces technical textile covering systems for biogas plants and manure silos. The company employs approximately 80 people Flexxolutions was founded in 2012 and, in addition to a sales office in Oldenzaal, has a large production facility in Bad Bentheim. The company produces and assembles extensive technical textile membranes that are used to cover digesters in biogas installations or manure silos. The double membrane for biogas installations is mounted airtight on the walls and can breathe with the amount of gas in the digester. In addition to covers, the company produces innovative disinfection mats for use in food production and stables. Flexxolutions realizes worldwide sales through direct sales and a dealer network. Anders Invest has acquired the shares in Flexxolutions from the current owners Martin Nieuwmeijer, Ronnie Beld and Christian Lansink, who are committed to the company as minority shareholders for the long term. Together with the existing management team, they will remain actively involved in the continuous growth and professionalization of the organization.

25 july 2023

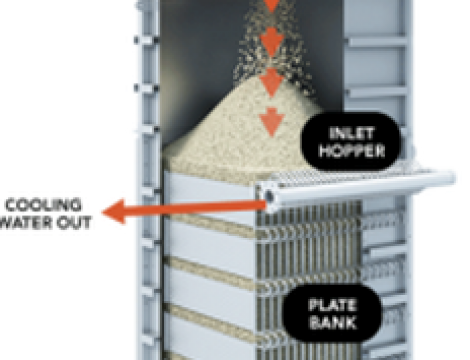

Solex Thermal Science Inc. acquires Econotherm Ltd. CALGARY, AB, Canada, July 12, 2023 – Solex Thermal Science Inc. (“Solex”), a Canadian-headquartered expert in thermal and bulk materials engineering, is pleased to announce that it has acquired Econotherm Ltd. (“Econotherm”), a UK-based leader in waste heat recovery technology. The acquisition further expands Solex’s capacity to help its customers reduce the primary energy consumed to produce industrial goods. The company has deep expertise in solids, liquids and gas heat exchange, and Econotherm’s solutions are welcome additions to the suite of products Solex offers. For more than 30 years, Solex has established itself as a global leader in supporting its customers during their respective journeys to decarbonize operations while producing a better product at less expense to them and the environment. “We at Solex are passionate about working with customers to understand their operational needs. Today’s announcement broadens our overall business portfolio to provide our global client base with an even deeper suite of best-in-class, sustainable solutions that align with their respective environmental, social and governance strategies,” says Lowy Gunnewiek, Chief Executive Officer for Solex. Econotherm is a recognized leader in the design and manufacturing of heat pipes and exchangers for industrial waste heat recovery. The company focuses on difficult-to-recover heat that includes hot and/or dirty exhausts in industries such as automotive, metals, construction, food, mining, oil and gas, power generation and pharmaceutical. Installed solutions include many “firsts of its kind” which have achieved successful energy savings in applications otherwise considered unsuitable for conventional equipment. The company is also at the forefront of heat pipe research and development, having been recognized with green technology awards from Shell Oil and LLGA City Smart for its leading-edge developments. Econotherm has participated in a number of international EU- and UK-funded research and development projects where its deep expertise in heat pipes has contributed to new developments for industrial waste heat recovery solutions. “Solex’s commitment to making a sustainable impact within the industries it operates aligns with our company’s trajectory of being a world-leader in today’s circular economy. Having the support of Solex will allow us to expand the reach of our patented heat recovery solutions and create a positive impact in the world around us,” says Mark Boocock, owner at Econotherm. About Solex Thermal Science Solex Thermal Science is the global market leader and developer of high-efficiency, indirect heat exchange technology for the heating, cooling and drying of free-flowing granular materials such as solid granules, pellets, beans, seeds and particles. Over the past 30 years, the company has installed more than 900 advanced heat exchangers in more than 50 countries worldwide with applications such as fertilizer, oilseeds and industrial materials such as minerals/sands, chemicals and polymers. In recent years, the company has expanded into the energy-transition sector with key collaborations globally on decarbonization applications such as industrial waste heat recovery, concentrated solar power (CSP) and carbon capture. About Econotherm Econotherm (www.econotherm.co.uk) is a leading UK-based manufacturer of heat pipe waste heat recuperators, economizers, pre-heaters, steam generators and steam condensers. The company’s patented super conductor heat pipe technology is used in a wide range of applications across many diverse industrial sectors. For further information please contact: Solex Thermal Science Inc. Phone: +1 403 254 3500 Email: info@solexthermal.com www.solexthermal.com

13 july 2023

Industriefonds realizes capital round of € 50 million Last week we realized a successful capital round with the Anders Invest Industrie Fonds in which we raised more than € 50 million to invest in Dutch SME production companies with a turnover of approximately € 10 million over the next 12 months with their own product. The Anders Invest Industrie Fonds has an infinite duration and invests in companies for the long term without being exit-driven. The fundraising target was higher than ever before at €45-50 million in the 10th funding round. Enthusiasm among existing investors and new entrants was undiminished and led to subscriptions of € 75 million, of which we allocated more than € 50 million. We had to disappoint various investors with a lower than desired allocation. The more than 120 new investors for whom we were able to make room participate for an initial investment of € 100,000. In this round, as with every round, there was plenty of room for getting out. In this way, the long-term fund is still a liquid investment.

17 may 2023

Anders Invest acquires Burgers Anders Invest has acquired Burgers Carrosserie from Aalsmeer. Burgers, founded in 1925, is a manufacturer of special Double Deck Trailers. The company has a turnover of approximately € 40 million and employs more than 85 people. Burgers, which is almost 100 years old, produces Double Deck Trailers and customized trailers at its location in Aalsmeer, where it has an in-line assembly and paint shop. Due to its optimal use of space, the Double Deck Trailer has approximately 60% more loading capacity than a conventional trailer. Not only can one driver transport more freight, the increased loading capacity also increases the efficiency of logistics handling. Due to the demand for sustainable transport solutions and shortages of logistics workers, Burgers still sees a lot of growth potential for the Double Deck Trailer. Burgers supplies its trailers to leading customers including Action, Zeeman and Jumbo. In addition, Burgers serves customers with maintenance and repairs from service locations throughout Europe. The shares in Burgers have been acquired from Ton Burgers and Jan Verweij. In addition to Anders Invest, Jeroen Naalden, CEO of Burgers, is also taking an equity interest in the company.

10 may 2023

NNDI acquires Galvano Techniek Schumacher Industriefonds portfolio company North Dutch Wire Industry (NNDI) expands again; it has acquired the shares of Galvano Techniek Schumacher (GTS), also known as Schumacher Plating. The North Dutch Wire Industry from Dokkum produces bare steel wire, reinforcing steel and wire nails for construction and industry throughout Europe. Galvano Techniek Schumacher (GTS) is the specialist in the field of nickel plating and galvanizing. Both companies — with 55 and 10 employees respectively — have modern production facilities, deliver high quality and are able to quickly deliver custom work. On April 12, NNDI took over the shares of GTS. This guarantees continuity for the Schumacher Plating staff. The companies have been working together in a joint venture since 2012. In Dokkum, NNDI draws the wire, which is then electrolytically galvanized at GTS in Uden. The galvanized wire goes to NNDI customers and has many applications. GTS, or Schumacher Plating, also specializes in galvanizing steel wire with nickel and brass. Until now, these wire products have been marketed by GTS itself, but since the takeover, sales have been made via NNDI. NNDI is proud to further develop a broader portfolio in the market. In March 2023, NNDI completed the acquisition of wire drawing company Van Meirvenne from Belgium.

26 april 2023

Participation Anders Invest TBK Group On April 18th 2023, Anders Invest realized a 60% participation in TBK Group B.V. from Renswoude. The company develops solutions for minimizing pollution and dust emissions related to bulk handling and employs approximately 30 permanent employees in the Netherlands. The company from Utrecht was founded in 1956 and produces scrapers, seals and dedusting installations for use in bulk handling, feed and food processing and recycling, among other things. The company serves customers such as Tata Steel, Renewi, ArcelorMittal and Cargill with its own service network. Internationally, TBK is active with a dealer network in Europe and Australia. The company has a modern production location in Renswoude where the products are designed and assembled. The shares in TBK were acquired from Wijnand van de Vendel and Bart Kelderman. Bart has completely withdrawn from the company due to health reasons. Wijnand will remain associated with TBK as director and shareholder. In addition to Wijnand, Stan Egging succeeded Bart as director and shareholder. This participation does not result in any changes for employees, customers and suppliers. The same people will continue to do their utmost to deliver optimal products every day. The entry of Anders Invest guarantees the continuity of the company for the long term and further implements strong demand development and international growth. TBK Group is 100% owner of: IFE Benelux, Spillage Control, DCP Benelux and TBK Services.

19 april 2023

Anders Invest acquires Van Meirvenne Anders Invest took over wire drawing company Van Meirvenne from Beveren (Belgium) this week. In 2022, the company achieved a turnover of approximately € 50 million and employs more than 20 employees. Since June 2022, Anders Invest has been a shareholder in wire drawing company Noord Nederlandse Draad Industrie from Dokkum. The family business was founded in 1955 and the third generation is now active with director and shareholder Nick van Meirvenne. Van Meirvenne uses its extensive and highly automated machine park to produce rods and coils of cold-drawn wire steel. The products are used in concrete reinforcement and customers are mainly concrete producers and construction companies in Belgium and the Netherlands. In June 2022, Anders Invest acquired the shares in wire drawing company North Dutch Wire Industry (NNDI) from Dokkum. NNDI and Van Meirvenne are now jointly part of Draad Industrie Holding B.V. and will collaborate intensively where appropriate. For example, NNDI and Van Meirvenne can use each other's production capacity and knowledge. The two companies offer a broad portfolio of wire products; from bare drawn wire to reinforcing steel. The shares in Van Meirvenne have been taken over from Nick van Meirvenne. Together with co-director Dieter Goeminne, he commits himself for the long term as a minority shareholder and together with the recently appointed director of NNDI, Ernst Dijkstra, they manage the combination of both companies.

15 march 2023

Willem Drissen Investment manager Good news! Willem Drissen, who has been working at Anders Invest for almost 5 years now, has received his well-deserved promotion to Investment Manager. Willem is an investment manager at Vormenfabriek (Tilburg) and Brabant Groep (Oosterhout). Congratulations and we hope to work with this topper for many years to come!

09 march 2023

Participation Bakker Hydraulic Products On February 23, 2023, Anders Invest realized a 44% participation in Bakker Hydraulic Products from Elst. The company manufactures hydraulic grabs and employs approximately 50 permanent employees in the Netherlands. The Gelders family business was founded in 1939 and produces hydraulic grabs and container emptying systems for applications in recycling, earthmoving, scrap processing and construction. It carries the brand names Bakker Hydraulic Products and Gusella Bakker and serves appealing customers such as Palfinger, Hiab, Hyva and Fassi. The company is the market leader in the Netherlands in the segment of grabs for truck-mounted cranes. Bakker has an interanational precense with its own branches in France, Italy and the United States. In Elst, the company has a modern production location where, with various welding robots, assembly lines and its own paint shop, dozens of products are delivered per week. The shares in Bakker have been acquired from Harm Bakker. The company was founded by his father and Harm has been involved in the company from an early age. In addition to Harm, his two children also work at the company. This participation does not result in any changes for staff, customers and suppliers. The same people will continue to do their utmost to deliver an optimal product every day. The entry of Anders Invest ensures the continuity of the company for the long term and further implements strong demand development and international growth.

06 march 2023

Matthijs and Gert-Jan partner We are pleased to announce that Matthijs van der Ham and Gert-Jan Verhoef have become partners at the Anders Invest Industrie Fonds. After the sale of their own (production) companies, both gentlemen have been involved with the Industriefonds since the beginning of 2021 as hands-on investment managers in a number of the investments. With their partnership, their commitment to our manufacturing companies is guaranteed for the long term.

02 march 2023

Rien Wisse starting at Anders Invest As of January 1, 2023, Rien Wisse will start as Investment Director at Anders Invest Industrial Fund. He has 20 years of experience as CEO of BUVA, an innovative company in the field of hinges and locks for doors and windows, home ventilation and sustainable heating concepts. Due to the transition from product sales to sales of energy concepts, BUVA grew in its time from € 25 to almost € 70 million in turnover per year. Rien brings relevant operational experience from the results achieved at BUVA: Digitization: strong transition to digital processes, for example EDI with customers and suppliers, ERP implementation, controlling machines at another location, remote working for everyone, etc. Production automation: converted to 24/6, of which manned 8 hours a day. Rest of the day BUVA is a “dark factory”. Logistics concept: at BUVA everything is delivered on trolleys. Pallets, cardboard, plastic have been abolished as much as possible. Before that, Rien worked for more than 10 years at Alcoa Bouw Groep in management positions of companies that supplied the construction industry. His background is in HTS Architecture and Business Administration. Within the Industry Fund he will be responsible for companies from the construction cluster: Bincx (including Hutten Metaal), Bos Machines, Topvorm and VIOS. Together with the other 12 industry professionals, Rien will further expand the Anders Invest Industrial Fund. We look forward to his arrival.

06 december 2022

Anders Invest buys NNDI Anders Invest has today completed a 100% participation in the Noord Nederlandse Draadindustrie (NNDI) from Dokkum. NNDI specializes in the production of wire for a wide range of industrial applications, including reinforcing steel. NNDI has a turnover of approximately €50-55 million and employs more than 55 employees. NNDI is a continuation of the Leeuwarden Wire Industry, which was founded in 1928. The company has developed into a specialized production company for the production of drawn bare wire and reinforcing steel on coils and bars. The company also produces wire nails. Bare wire is used, for example, in hinge pins, car seats, wire baskets, nails, suspension brackets and shopping trolleys. NNDI has a spacious and modern production facility in Dokkum. Due to the variety of finishing operations, flexibility in the machinery and qualified employees, NNDI is able to quickly serve customers with deviating wishes regarding finishing, dimensions and order size. Customers throughout Europe are served from Dokkum. Anders Invest has acquired its interest from the current owners of NNDI and will continue to work actively with the current management to continue the growth and further professionalize the organization.

04 july 2022

Christian Haket partner at Anders Invest Due to the strong growth of Anders Invest's industrial activities, it was decided to let Christian Haket join the partner group. Christian has been employed by Anders Invest since April 2019. He studied mechanical engineering at Delft University of Technology, supplemented by a part-time master's degree in business administration at Nyenrode. After his studies, he worked for Van Dorp, one of the largest installation companies in the Netherlands, for 7 years as board secretary, sales & marketing manager and board member. Gert-Jan Huisman, managing partner at Anders Invest: ”Three years ago, Christian took a significant risk by entering the new world of the manufacturing industry from a director role at Van Dorp. With his technical background, intellectual sharpness and social qualities, he has made a major contribution to the growth of the Industry Fund. We are pleased with his knowledge and his enthusiasm for a sustainable and circular future. We are confident that, together with the current partners, he will help build Anders Invest and the impact we would like to have by showing that things can be done differently.”

04 july 2022

Participation Arte Last week Anders Invest realized a 70% participation in Arte Holding from Helmond. Arte is a top player in the production of sustainable worktops in granite, composite, Dekton and ceramics. Arte has a turnover of approximately € 15-20 million and offers employment to 65 employees. Arte started in 1995 in Deurne and since the move to Helmond in 2001, production has been carried out with high-quality machinery and advanced automation. Arte produces kitchen worktops and stone applications for interior projects. Sale is to a wide circle of kitchen specialists, interior designers and architects in the middle and high segment. Arte has a modern and highly automated production facility with CNC machines, polishing machines, water jets and robotized transport and storage systems. The company has a strong eye for sustainability and CSR and has been nominated for the Koning Willem I prize for this. In addition to an independent foundation, Arte has set up a project: 'Arte Right To Education' (A.R.T.E.) with the aim of creating a child labor free zone around the quarries where Arte purchases its granite. Anders Invest acquires its interest from founder and general manager Hugo van Osch. Niels van den Beucken will retain an interest in the company and will manage the company together with new shareholder Froukje van Osch. Anders Invest will continue to work actively with the current management to continue growth and further professionalize the organization.

27 june 2022

Anders Invest signs 100% participation Royal Leerdam - Crisal Anders Invest has signed an agreement to purchase a 100% participation in Royal Leerdam and its affiliated company Crisal – Cristalaria Automática S.A. The companies manufacture table glass for the European market from the Netherlands and Portugal( under the Royal Leerdam and Crisal Glass brands, has a turnover of approximately € 120 million and employs more than 600 employees in the Netherlands and Portugal. Glass has been produced in Leerdam since 1765. With the arrival of the glass factory in 1878, Royal Leerdam was founded. With the Crisal factory in Portugal, founded in 1944, Royal Leerdam has grown into a strong player in the European market of table glass. The company operates from the production site in Leerdam in the Netherlands and Marinha Grande in Portugal. In addition, the distribution center is located in Gorinchem. Royal Leerdam and Crisal serve customers in retail, wholesale and hospitality throughout Europe, Australia, India, New Zealand and the Middle East. Anders Invest has acquired its interest from Libbey Glass LLC. Libbey has decided to divest its European activities in order to strategically prioritize and expand its business within its core markets, especially the Americas. The closing of this transaction is anticipated to occur at the end of this month. Following the close of the transaction, Libbey and Anders Invest will maintain an ongoing commercial relationship, including uninterrupted access to products and other support.

18 may 2022

Directors‘ Day 2022 On Wednesday 11 May 2022, the annual Directors' Day of the Anders Invest Industriefonds took place again. An extraordinarily inspiring and energetic day in Maarsbergen where all directors / MTs of the portfolio companies were invited. There were approximately 70 participants. We talked about sustainability, employee development and diversity. Especially themes related to people and planet. Companies shared challenges and solutions with each other. Despite (or perhaps thanks to) the different end markets in which the companies are active, challenges are very similar and a lot is learned from each other.

17 may 2022

Anders Invest seeks € 100 million capital round Anders Invest is growing rapidly: with 25 employees, 18 transactions have been completed in 2021 and a large number of investments are still in the pipeline. Major capital rounds will start in April at the corporate funds in industry and food & agri and the property fund for rental properties. The recruitment target amounts to a total of approximately €100 million in new capital. Value development in the two large, longer-established industrial and rental housing funds is good and the dividend paid has also increased. The 25 companies in the industrial fund have been hit by the commodities crisis, parts shortages and inflation, but are showing resilience. Despite the turbulence, 2021 was closed with a total performance of 13.9%. The expected effects of the Ukraine war have been included in the valuation in individual cases. Since its inception at the end of 2015, the fund has achieved an average return of over 15% per year. The portfolio companies paid more dividends to the fund, which allowed the dividend to be increased to investors. The industry fund will then have realized an average payment of 8% per year over a period of 7 years. The unique approach and network in the manufacturing industry provide access to new investment opportunities, increasingly as an addition to existing companies. Multiple opportunities are at an advanced stage, kicking off the 9th capital round with a recruitment target of €35 to €40 million. One of these projects is the acquisition of a well-known Dutch consumer products manufacturing company with a turnover of more than €100 million. This will lead to the establishment of a 3rd co-investment fund, for which recruitment has also started. The rental housing fund, the second largest fund of Anders Invest, also developed well. Satisfied tenants and low vacancy rates ensure good operational results. The fund's total performance in 2021 is over 17%. This brings the average performance since the start of the rental housing fund in autumn 2017 to more than 12% per year. Here too, a significantly higher dividend is paid, bringing the average dividend since the start to more than 3.3% per year. The fund recently invested in more than 600 largely new homes in Groningen and Harderwijk that will be built in 2022 and 2023. The purchase price and the expected return on these new projects are good, which means that an investment in the 6th capital round that has now started has an attractive return/risk profile. The recruitment target is between €25 and €30 million. The food&agri fund, which was launched in 2021, has so far made five acquisitions, mostly in the field of healthy and sustainably produced food and animal feed. The most recent investment by this corporate fund concerns Service2Fruit, an online platform for the auction of fruit and vegetables. It offers complete transparency for top fruit online, making it easier for supply and demand to find each other. The fund, which is less than 1 year old, realized a value increase of almost 5%. The team has been expanded with two colleagues so that we can work together with the companies on growth and returns, both financially and in the field of sustainability and social impact. There are currently two promising propositions in the due diligence phase. Further acquisitions are expected in the course of the year and therefore the fund is starting to raise for the 2nd capital round of €15-20 million. Registrations for these 3 capital rounds and the co-investment opportunity close at the end of April. Another round of capital is expected to be launched at the healthcare real estate fund around the summer.

06 april 2022

Investment in Geraedts Ijzergieterij On December 30, 2021, Anders Invest realized a 60% participation in Geraedts IJzergieterij from Baarlo. The company manufactures castings from lamellar and nodular cast iron. Geraedts employs approximately 20 permanent employees. It is Anders Invest's 26th participation in its industrial fund. Geraedts, a North Limburg family business founded in 1935, produces castings from lamellar and nodular cast iron for the mechanical engineering, automotive and maritime industries. The company is a hand-moulded foundry specializing in small series up to 16 tons. In the factory in Baarlo, melting is done by means of electro-induction furnaces, which leads to a process with a significantly lower CO2 footprint than using traditional gas cupola furnaces. Geraedts serves customers in the Netherlands, Germany and Belgium from Baarlo. By supplying high-quality products, a diversified customer base and by being a reliable and flexible partner for its customers, Geraedts has proven to be very stable and profitable. The Geraedts family will continue to play a key role within the company. Jan Geraedts, former chairman of the trade association and icon in the sector, will retire from the company in view of his age. He conducted the management together with his son Bart, who will remain as general manager. His cousin Mike Geraedts will join the board. Anders Invest, as a partner with a long-term focus, will continue to build the future of Geraedts IJzergieterij together with the family. The trend of local sourcing, demand for increasingly high-quality products and focus on product and customer diversification lead to attractive growth prospects.

31 december 2021

Anders Invest acquires Bincx Anders Invest has acquired a 60% participation in Bincx from Kootwijkerbroek. The company engineers, produces and installs steel structures for non-residential construction. Bincx has a turnover of approximately € 80 million and employs more than 100 permanent employees. Bincx was founded in 2001 and has since grown into one of the larger players in the Netherlands in the field of steel structures for industrial real estate and utility construction in various applications such as production halls, offices, schools, logistics real estate and agricultural applications. The company operates from production and assembly halls at various locations in the Netherlands. The German market is served from Gronau. Bincx has an engineering department, production with CNC machine lines, a large number of mobile cranes and its own assembly teams. In addition to mounting the steel structures, prefab concrete walls and sandwich roof and facade elements are also mounted. The culture is innovative, with an average of young employees, and there is room for new ideas and self-organization. The company's customer base consists of established (international) construction companies and contractors in the Netherlands, Belgium, France and Germany. Bincx also works with a number of Dutch system integrators who deliver turnkey projects in emerging markets. Anders Invest acquired its interest from founder and director Wilco van den Brink. Mr. Van den Brink will retain a 40% interest and, together with the management, will continue to work actively to achieve further growth and professionalize the organization.

21 october 2021

Acquisition Lieverdink Anders Invest Groeiplatform, part of the industry fund, realized a 100% participation in Lieverdink from Doetinchem on 7 October 2021. The company manufactures parquet floors and is the market leader in the Netherlands in the field of tapestry floors. Lieverdink employs approximately 25 permanent employees. It is Anders Invest's 24th participation in its industry fund. Lieverdink, a family business founded in 1986 in the Achterhoek, produces high-quality traditional parquet floors. Strips, herringbone motifs and patterned floors are produced from more than 30 types of wood. In addition to traditional parquet, Lieverdink has developed its own line of two-layer parquet (Q2) specifically for use in combination with floor heating. In Doetinchem, the company has several production lines where the parquet is machined from raw planks. The company is a benchmark in the parquet industry and counts more than 800 parquet fitters among its clientele. This ensures that Lieverdink is able to realize a stable turnover with good results. The shares in Lieverdink have been taken over from the current owners, Gerben and Eric Lieverdink. The parquet factory was founded by their parents and they have been involved in the company from an early age. Gerben and Eric will remain associated with the Parketfabriek as directors for the foreseeable future. With them continuity is guaranteed and Anders Invest sees an attractive growth perspective due to the strong developments in the housing sector and opportunities in the field of internationalization.

10 october 2021

Brabant Groep acquires Euroblast Brabant Groep from Oosterhout, part of the Industriefonds of Anders Invest, has acquired the shares of Euroblast N.V. from Belgium. Brabant Groep focuses on corrosion prevention projects for various sectors such as tank construction, steel construction, petrochemicals, civil engineering, utility construction, shipbuilding and energy. Euroblast is located near the port of Antwerp and specializes in blasting and preserving steel plates for shipbuilding, tank construction, offshore applications and industry and works for Belgian, European and intercontinental customers. With the acquisition of Euroblast, Brabant Groep obtains greater geographical coverage and can serve its customers more widely. In addition, synergies can be achieved through more efficient business operations, improved use of the various locations and the sharing of logistics, facilities and work processes. Euroblast will continue to operate under its own name. This is the second expansion for Brabant Groep this year. In June, a merger between the Brabant Group entity Straco Heerenveen and Staal Technische Centrum Noord-Nederland (STC) was realised. Straco Heerenveen is active in the field of wet painting and powder coating. STC is active in blasting and wet coating applications. In time, the facilities will be expanded with a new aluminum coating line.

08 october 2021

Investment in TMS Werkendam On 26 May 2021 Anders Invest acquired 70% of the shares in TMS from Werkendam. The company develops and assembles custom mechanical installations for use in offshore wind, maritime and civil markets. TMS has a turnover of € 15-20 million and employs approximately 25 permanent employees. It is the 22nd investment in the Anders Invest Industry Fund. Founded in 1994, TMS focuses on the engineering and delivery of unique custom installations that are used, for example, in the construction of offshore wind farms. Think of pile plugs and foundation installations for the French offshore wind farm at Saint-Nazaire and special cranes and manipulators for use on ships and civil works. The company's customer base consists of established (international) players active in offshore, maritime and civil markets. TMS is involved by its customers from the concept phase in the engineering of the special and deviating solutions that are required for the ever-changing applications and increasing safety requirements. The TMS workforce consists mainly of engineers. Production of the specific parts is outsourced to partners, the final assembly takes place in-house. The company is located in the harbor of Werkendam, where it has a modern office, recently built assembly halls and quay facilities. Anders Invest acquired its interest from the current owners of TMS, Mr Cees van Wendel de Joode and Mr Marco van Driel. They founded TMS in 1994 and since then the company has grown strongly. In mid-2020, the management was supplemented with the arrival of Mr Jan Albert Westerbeek. Jan Albert, former CEO at IHC IQIP, has a large network in the industry in which TMS is active. His experience with processes and adjacent markets are of great value for the further professionalization and expansion of TMS. The management jointly holds a 30% interest and remains associated with the company for an indefinite period of time.

26 may 2021

Anders Invest participates in Banzo On March 31, 2021, Anders Invest realized a 60% participation in Banzo from Hoogeveen. The company designs and supplies recycling installations. Banzo has a turnover of € 15-20 million and employs more than 35 permanent employees. For Anders Invest, it is the 21st holding in its industry fund. Founded in 1947, Banzo ( website ) designs, assembles, installs and maintains recycling facilities for all major Dutch garbage processors. The company specializes in so-called post-separation installations, in which residual waste (gray waste flow), green waste or construction / demolition waste is subdivided into separate waste flows that can then be further upgraded to valuable residual flows and raw materials with additional reprocessing installations. In this way, waste processors are able to reduce waste incineration and Banzo contributes to the cradle-to-cradle use of raw materials. The Netherlands is at the forefront in the approach to recycling, changing legislation in the European Union that prevents landfilling and incineration of waste offers opportunities for Banzo abroad. Anders Invest has acquired its interest from the current owner and general manager Mr Marcel Kroon. He took over Banzo in 2011 and the company has grown significantly since then. After the takeover, the focus will mainly be on further professionalizing the company and making use of the international expansion opportunities that the company has. Mr Kroon will remain with the company for an indefinite period as shareholder and general manager and looks forward to furthering the company together with the team in Hoogeveen and Anders Invest.

31 march 2021

Visscher Caravelle is expanding On August 26, 2020, the industrial fund participation Visscher Caravelle acquired UGF Sud from Portugal. The accessory activities of UGF Industry (UGF OES) in France were also acquired. Both parts have been added to the VanProtech division of Visscher Caravelle. This division is mainly active in the production of Van Protection Panels and accessories that protect the inside of delivery vans. UGF Sud and UGF OES produce Van Protection Panels for PSA, Opel and Toyota. The combined turnover of these two activities is approximately € 5 million. UGF Sud will continue to manufacture and sell from Portugal as an independent group company. Delivery is made directly to 2 PSA factories in the region. UGF OES will be transferred to VanProtech Poland and fully integrated therein. With this acquisition, Visscher Caravelle Automotive can expand its Van Protection activities by 70%. It also means a substantial expansion of its customer portfolio within this activity, a great next step in the strategic plan to become the European market leader in Van Protection products for car manufacturers. Anders Invest stepped in 2 years ago to realize these and other growth plans together with the owner's family. The turnover of the company with 1,880 employees worldwide was € 161 million in 2019. Tiemen van Dijk, CEO of Visscher Caravelle: “As management, we are very happy with this transaction. While the crisis is still under us, Visscher Caravelle has managed to stay on course and that is what makes this transaction possible. We would like to thank all Visscher Caravelle employees for their contribution to this. ”

11 september 2020

Expansion of interest in Brabant Group On July 7, 2020, in accordance with the agreements in the 2017 shareholders' agreement, Anders Invest acquired the shares (30%) held by Dick Ravensbergen and Erik Drijver in the Brabant Group. The industryfund now fully owns the company. At the beginning of June, Dick and Erik stepped down as management and Arie Vergunst became general manager. In consultation with Dick and Erik and the management team, an experienced successor has been found in Arie Vergunst who will work with the existing management team to continue the developments that the company has initiated in recent years. Arie, former CFO of Royal IHC, has broad experience in general and financial management positions. Dick and Erik will remain connected to the company as an advisor to ensure a smooth transfer, whereby their knowledge and skills will be of use to the company for a longer period of time. The Brabant Group has a good reputation and a leading position in the blasting and preservation industry in the Netherlands. In the past challenging months, turnover has also remained at a reasonable level and Brabant Groep is working on fantastic projects. The steel treated by the Brabant Group is used in many different end markets, including shipbuilding, civil engineering and (petro) chemicals. On behalf of Anders Invest, we thank Dick and Erik for their many years of commitment to the Brabant Group and we look forward to continuing to build this beautiful company together with the new management and all employees.

07 july 2020

Anders Invest acquires Vormenfabriek Anders Invest acquired Vormenfabriek from Tilburg in June 2020. Vormenfabriek, founded in 1921, is one of the world's top players in molds for the international food industry. The company has a turnover of € 8-10 million and employs more than 60 people. For Anders Invest it is the 18th participation in its industry fund. Vormenfabriek is one of the world's leading players in the design, development, engineering and production of polycarbonate injection molds, thermoforms and silicone rubber molds for the international chocolate and confectionery industry. The entire design, development and production process takes place in Tilburg. The company supplies its products worldwide and counts the major chocolate producers among its clientele. New shapes are designed in close collaboration with the customer's design and marketing teams. The company also realizes recurring turnover by supplying forms for long-term series. The shares in Vormenfabriek have been taken over from Mr. Rein Nooteboom, member of the second generation of the Nooteboom family who has been a shareholder of the company for 70 years. Anders Invest has acquired the shares together with Mr. Gert-Jan Kloppers, who has acquired a minority interest and will become the general manager of the company. Gert-Jan has extensive experience as a Managing Director in companies with international sales and marketing activities for technical products. The company is characterized by extensive technical expertise and a loyal and innovative team. Anders Invest and Gert-Jan Kloppers look forward to contributing to the future of this beautiful company. Due to the robust business cycle in which the Vormenfabriek operates, it is a good addition to the industrial fund.

03 july 2020

Participation Topvorm Anders Invest has acquired 50% of the shares in Topvorm Prefab from Terneuzen. The company has been growing rapidly for 10 years and is one of the leading players in the market for the production of prefabricated roofs for residential construction in the Netherlands. Topvorm realizes a turnover of € 15-20 million and employs more than 90 people. For Anders Invest, it is the 17th investment in its industry portfolio. Topvorm's core activity is the design and production of prefabricated roofs for new-build homes. The clients consists of renowned construction companies that purchase the entire engineering and production of the roofs from Topvorm. The company has expanded its product range with the production of dormer windows and prefabricated walls. Topvorm has a modern production facility with workstations and production lines where the prefab roofs and roof elements are produced. In our own sawmill, all parts are cut to size according to computer control (CNC). Anders Invest has taken over half of the shares in the company from the three founders and directors Wim Timmerman, Hans Stoffijn and John Cambeen. In the coming years, they will remain active as members of the board of Topvorm. Despite the short-term challenges, there is a large housing shortage and the long-term prospects for housing construction are good. Anders Invest therefore sees sufficient opportunities to achieve further growth together with the management and employees of the company.

20 april 2020

Directors day 2019 The annual Anders Invest Directors Day took place on Thursday 21 November 2019. Around 50 people gathered on the Anderstein estate in Maarsbergen. This time, the day was all about sustainability and good leadership. Frequently discussed topics that we give concrete substance to the companies.nders Invest presented the Inspiration Catalog: an online platform full of example initiatives that companies can take ...

12 december 2019

Anders Invest acquires interest in Solex Anders Invest and its Mosman co-shareholders have a controlling interest in Solex Thermal Science Inc. acquired. Based in Calgary, Canada, Solex, like Mosman, is active in the production and sale of indirect bulk heat exchangers. The expertise of Solex and Mosman are combined so that they can achieve optimal performance for their customers. Solex is a world leader in the development and sale of indirect heat exchangers for bulk bulk goods. In addition to the application in production processes of sugar, oilseeds and fertilizers, Solex has developed heat exchangers for a wide range of other production processes, for example for coffee beans, casting sand and energy storage media. The company has extensive expertise in product development and has a worldwide active sales team. In its 25-year history, Solex has maintained its position as the market leader in bulk bulk heat exchangers. Due to the increasing attention to energy consumption of the production processes and the desired high quality and consistency of product output, indirect heat exchangers are being used in more and more production processes. In recent years, Solex has invested heavily in the development of its technology for applications in a wide range of bulk bulk materials. Solex and Mosman will join forces to offer their customers optimal solutions. The locations in Calgary Canada and Haaksbergen Netherlands remain active and the combination of capacity enables Solex and Mosman to better serve their customers with products and services. As a result of the combination of the companies, the production of the heat exchangers will be concentrated in the Mosman facility in Haaksbergen and it is expected that this production location will be expanded.

09 september 2019