Healthcare real estate fund

Locations Involved Manageable risk Participation exemption Invest Volume Return

We invest with our own resources and with money from third parties in existing care homes, renovation, transformation and new construction. Our goal is twofold: high tenant satisfaction and an attractive return for our investors. The two go very well together, in our experience.

Involved

We like to involve investors in proposed projects. In this way we like to make optimal use of all knowledge and networks. We only make new investments with money that has already been committed. In other words: after the investor's mandate. When a property or part of the portfolio is sold, we distribute the net profit (the super dividend) to investors.

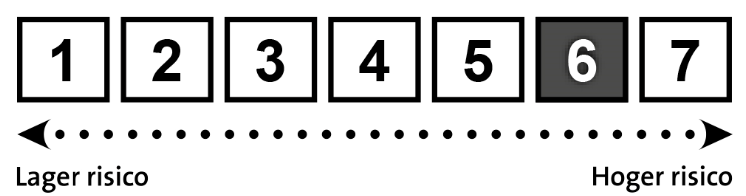

Manageable risk

We strive for a portfolio of high-quality care homes with a geographical spread and for different target groups. Through our involvement and expertise, we want to increase the rental value and usability for the healthcare institution. We expect a good return against a manageable risk. The latter is partly due to the fact that the demand for care will increase sharply and to the limited sensitivity to economic trends. Moreover, it often concerns a main lease and solvent parties.

As of 25 September 2025, Anders Invest Fondsbeheer has an AIFMD licence to offer and manage investment institutions in the Netherlands (Article 2:65, opening words and under a, Wft).

Past performance is no guarantee of future results.

Participation exemption

Anders Invest is a cooperative. Thanks to this legal form, the participation exemption also applies to interests under 5% in our current tax regime when participating from a BV. The risks are manageable by focusing on a segment with few vacancy risks, current properties and realistic financing.

Invest

Investors can join the fund on new capital rounds. Depending on the number of investment opportunities, we organize a capital round once or twice a year in which existing and new investors can invest in the fund. The first deposit is from €100,000. You become a member of a cooperative, a common and fiscally attractive legal form for funds. You always fall within the participation exemption, even with a small interest. Exit is in principle done by selling the membership rights to another investor. Anders Invest supports this process and therefore does not have to sell companies or properties.

Volume

Within a few years, the fund aims to achieve a fund volume of approximately €100 to €150 million in paid-up capital (equity). The fund has no maturity date and is therefore aimed at the long term. Participation is possible from €100,000 and the fund management itself invests substantially. The fund grows annually through capital rounds in which existing investors can participate with their pro-rata rights and there is often room for new investors to join.

Return

We expect a good return, consisting of dividend and capital appreciation, against a manageable risk. The rental income is paid to the investor twice a year after deduction of costs, redemption and tax. This already yields an expected return of 2.0 to 3.5% per year. The value development arises, among other things, through repayment of bank financing and rent indexation. If market conditions remain the same, the return can go to 6 to 7% per year, but circumstances will not remain the same. Market prices can go up, but the market will also go down again. We want to benefit from this with a flexible purchasing and selling policy. And selling a (large) part of the portfolio with a premium is one of the options.

I am looking for an investor for my object