Anders Invest Industry Fund

Are you considering investing in the Anders Invest Industrie Fonds?

Anders Invest Industrie Fonds is an investment company that exclusively invests in production and technical companies headquartered in the Netherlands. The legal form of the fund is a co-op with an infinite duration which allows it to invest in companies with a really long horizon. Each year, the fund raises new capital from its investors/members. Then new shares are issued based on the valuation of the underlying companies. This capital round usually also creates room for the entry of new investors and, if desired, the exit of existing investors. The initial deposit for new entrants is at least €100,000. The fund management have themselves invested a substantial part of their own capital in the fund.

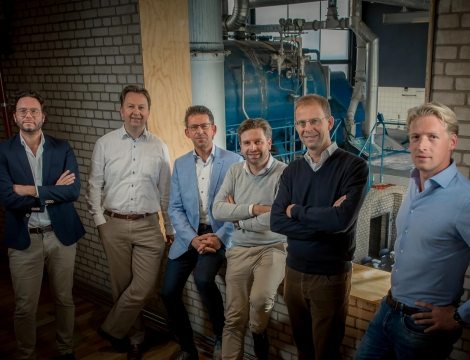

Involved

The Anders Invest Industrie Fonds team members have a background in the industry. They themselves have led companies of the type in which Anders Invest invests and have proven to be able to add a lot of value. The fund conducts active investment management, not spreadsheet management, but substantive involvement in the business challenges. By exchanging best practices, investment managers bring solutions to challenges to the table with all companies in the portfolio.

The members' meetings that take place several times a year are held at portfolio companies. In this way, investors are involved in the companies in which the Industriefonds invests. The members also contribute new acquisition opportunities.

Yield

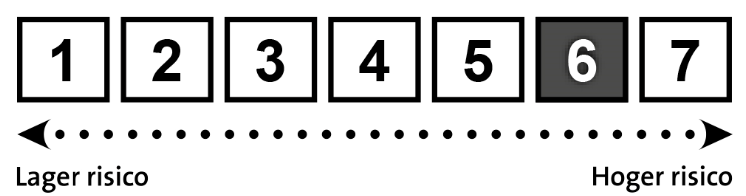

The Anders Invest Industrie Fonds has a diversified portfolio of high-quality and sustainably high-performing companies. We opt for healthy and growing companies where even more value can be realized with our involvement. We also successfully invest in turn-around cases. The investors in the fund realize return from two elements: dividend from the participations, which is paid annually to the members after deduction of costs, and the development of the value of the participations and thus the units that members hold in the cooperative. A very good return has been achieved of 16% p.a. (valuation per end of 2023) and the risk has proven to be manageable. Thanks to the cooperative legal form, the participation exemption also applies to interests under 5% in our current tax regime when participating from a BV. As of 25 September 2025, Anders Invest Fondsbeheer has an AIFMD licence to offer and manage investment institutions in the Netherlands (Article 2:65, opening words and under a, Wft).

Past performance is no guarantee of future results.

More about business takeover

_1_0_Trilo.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

_1_0.png)

_5_0.png)

.png)