Filter: industry real estate Food & Agri

Unfolding CSRD This article is part of a series of short blogs by the Food & Agri team at Anders Invest. This article is specifically written for individuals and companies that are interested in or affected by CSRD. In total, 50,000 companies will need to comply with this legislation in the coming years. Additionally, companies who do not need to report will face additional pressure to supply information and data regarding their sustainability performance from B2B customers. Are you involved with a company that will need to comply with the CSRD or needs to generate impact data? Then this article is meant for you. Let’s unfold it’s basic concepts together. The Corporate Sustainability Reporting Directive (CSRD) is a piece of legislation developed by the European Union which passed on January 2023. Starting January 1, 2024, CSRD intends to ensure that large and listed companies will report and disclose sustainability information in an elaborate and consitent framework in their management reports. It builds upon previous legislation through: an extended scope including a gradual integration of large companies, standardized requirements, assurance requirements, a digital format, and integration into management reports. Given the extensive scale of the directive, it is very likely that most companies are affected by this directive (either directly or indirectly). Let’s put together some basic concepts in this article to unfold CSRD and understand it’s mechanisms. Why did CSRD came into effect? CSRD aims to address climate change, stakeholer salience and governance malpractises. The driving force behind the CSRD is the European Union's ambitious goal, as outlined in the European Green Deal, to become the first climate-neutral continent and achieve a pollution-free environment by 2050. The Green Deal is the overall sustainable growth strategy of the EU. To direct capital to investments that drive sustainable solutions, the EU made an Action Plan on Financing Sustainable Growth (APFSG) which consists of a set of policy initiatives. To prevent greenwashing and set aligned activities for sustainable investments, the EU taxonomy regulatory framework came into effect in 2020. Basically, CSRD is required to increase transparancy through disclosure of sustainability information, enabling EU taxonomy to work. Overall, CSRD’s goal is not to report for the sake of reporting, but for the sake of transitioning to a green economy with the relevant public information to do so. However, it is difficult to asses how much of the effort will be translated to actual impact. How will CSRD impact the business climate of Europe? Starting in 2025, the first companies need to report on their ESG impacts and opportunities over the year 2024. CSRD compliance is phased in, depending on the type of company. The first report year for the application of the new regulations will be structured as follows: In 2025, companies already subject to the previous non-financial reporting standards, particularly large public-interest entities with more than 500 employees. The subsequent year, 2026, marks the inclusion of other large companies, specifically those with over 250 employees. By 2027, the reporting requirements will extend to include listed Small and Medium-Sized Enterprises (SMEs). Finally, in 2029, non-EU companies generating more than €150 million in revenue within the EU will also be required to comply with these reporting standards. Gradually, more than 50.000 companies will need to report a maximum of 11.000 datapoints per year. The European Reporting Advisory Group (who prepared the standard) estimates that the one-off costs are around €287.000 and recurring cost are €319.000 for companies the first companies to start in 2025. For later companies the costs are €146.000 (one-off) and €162.000 (recurring). As you can see, the amount of work and costs involved with the mere compliance, let alone impact, are significant. Next up, what is in the actual report? What will be in the report? Before CSRD, the annual report consisted of a management report, followed by an audit report and financial statements. The sustainability statements are based on the European Sustainability Reporting Standards (ESRS) and consist of General Information (ESRS-1), General Disclosures (2), Environmental information (ESRS-E), Social Information (ESRS-S), Governance Information (ESRS-G). Thus, CSRD is the piece of legislation as directed by the EU, ESRS are the standards that specify what to report. List of topical standards: ESRS E1 Climate change ESRS E2 Pollution ESRS E3 Water and Marine Resources ESRS E4 Biodiversity and Ecosystems ESRS E5 resource use and circular economy ESRS S1 Own Workforce ESRS S2 Workers in the value chain ESRS S3 Affected communities ESRS S4 Consumers and end-users ESRS G1 Business Conduct ESRS 1 and 2 serve as a guideline for the general sustainability reporting. The cross-cutting standards define the information to be disclosed about material impacts, risks and opportunities related to sustainability aspects. An understanding of the structure, concepts and general requirements for the preparation and presentation of sustainability information is to be reported. For the topical standards, one is required to conduct a double materiality assesment to map impact, risks and opportunities in relation to the different topics. All topics that are material in the value chain of the company have to be reported and substantiated with data. Accordingly, all topics whose impacts are either materially related to the environment or society (impact materiality, inside-out) or which have a short-, medium- or long-term financial impact on the company and can thus significantly influence the company's development and performance (financial materiality, outside-in) have to be reported. Once all material points are covered, the report will be auditted by an external assurance party. As you may see, it will prove difficult to operationalise this directive and the amount of abbreviations by itself is a real headache. In the next article, we will go in more detail on the impact on the business landscape for Food & Agri and what our strategy involving CSRD is.

02 may 2024

Generational Gastronomy: Understanding Unique Eating Habits This article is part of a series of short blogs by the Food & Agri team of Anders Invest. Here, we outline our perspectives on key themes that are relevant to the Food & Agri sector and explain how we try to make an impact with our portfolio companies and investment strategies. In this piece, we delve into the various generations: Baby Boomers (born between 1946-1964), Gen X (born between 1965 and 1980), Millennials (born between 1981 and 1996), and Gen Z (born between 1997 and 2012). What makes their eating behavior unique? And what trends and similarities emerge? Health: A Cultural Shift Health is a universal value, but the way different generations approach it varies significantly. For Baby Boomers healthy eating is central, especially because they are becoming older and are developing age-related ailments. Therefore, they see food as a way to improve their quality of life and stay healthy for longer. When looking at the advantages Baby Boomers want to gain from food, these mostly relate to reducing the risk of diseases like cardiovascular disease and cancer. In order to achieve this, the Baby Boomers in are likely to focus on natural foods and are motivated to practice what they preach in terms of maintaining a healthy diet. While Gen X also sees healthy eating as central and wants to improve their quality of life to stay healthy longer, Gen X’s approach is slightly different and is focused on having a healthy weight and following weight loss diets more than other generations. In contrast, Millennials and Gen Z are more aware of a holistic approach to health, where mental health is seen as equally important as physical health, which can for example be explained by the fact that these two younger generations report to experience more stress and mental health issues than Gen X and Baby Boomers. In practice, this means that Millennials and Gen Z are becoming more aware of the link of e.g. sugary foods to depression or of caffeine excesses to anxiety, thus leading them to avoid such foods. Furthermore, their holistic view also means that a big part of Millennials and Gen Z believe that a healthy diet is about more than calorie counting and following restricting diets. For example, many people within these generations believe that calorie counts on food packaging can have a bad effect on mental health. Though Millennials and Gen Z thus view health as having both a physical and mental component, there are also some differences in their attitudes towards food. Millennials on one hand, prefer fresh and unprocessed foods and are the biggest buyers of fortified foods, so foods with added vitamins and minerals. For Gen Z, one of the most important benefits they seek from food is to improve their sleep and downtime. Dining Out: The Evolution of Dining Experiences The restaurant landscape is undergoing a transformation driven by the preferences of different generations. While Baby Boomers and Gen X prefer rare but luxurious dinners with more traditional tastes and dining concepts, with gen X sometimes enjoying personalized twists to well-known meals. Millennials and Gen Z focus more on the experience and social aspect. Convenience is also paramount for these two generations. Gen Z and Millennials are aptly dubbed the convenience generations, and this concept aligns well with their dining preferences: they seek accessible moments of enjoyment that fit their busy lifestyles. They spend significantly more on dining out than older generations, but simultaneously have a smaller disposable income. This explains the growing popularity of affordable and informal dining establishments among Millennials and Gen Z. Engagement: Food for Thought An notable trend among Millennials and Gen Z specifically, is their increasing engagement with the societal impact of food. While all generations indicate that they consider this important, Millennials and Gen Z clearly place the most value on this. For Gen Z, food even is a way to express themselves; the majority says that the food they consume is indicative of who they are and that they can use food to show their identity and beliefs. They value transparency, sustainability, and social responsibility in the brands they support and want to know their food choices have a positive impact on the world around them. This also greatly influences the loyalty they feel towards a brand, as a large portion of these two generations expresses willingness to pay more for a company that makes a positive impact. Their loyalty directly translates to the problems Millennials and Gen Z view in the world and their relationship towards food. Gen Z for example, is most worried about the environment and climate change, followed by Millennials. In this case, it is interesting that Millennials have more positive ideas towards the impact they can make, as they are most likely to believe that their food choices have an impact on the environment. Another slight difference between Millennials and Gen Z is that Millennials have an additional preference for smaller brands, while Gen Z supports brands that reciprocate their personal values, regardless of size. Digital savviness: Finding Balance in Food Choices Digital culture plays an increasingly large role in eating behavior, which is especially the case among Millennials and Gen Z: from restaurant reviews to nutritional information to new recipes, they use social media both to gain and share food-related information, like new recipes from different cultures to sharing pictures of their food online. Gen Z mostly turns to social media like Instagram and TikTok to gain advice on for example healthy eating, as they feel like they lack information from the government, educators and the food industry. Millennials on the other hand also use social media, but tend to put more trust in online apps and tools to help them improve their diet and physical wellbeing. A downside of social media and the constant influx of information is that Gen Z in particular, can feel overwhelmed, also when it comes to food. They want to consume food that looks good on pictures, while also being sustainable, ethical and socially conscious and if possible healthy. This leads to people in this generation often struggling to make, what they feel, is the right choice. Companies that can provide clarity in this regard, will therefore be ahead with Gen Z. Each Generation Has a Unique Need These food trends demonstrate how the Food & Agri sector is adapting to the changing preferences and values of different generations. It's clear that there's no one-size-fits-all approach; successful companies will need to adjust to the unique needs of each generation, whether it's related to health or engagement and whether it is inside the house, or out (and about).

15 march 2024

Net-Zero Emissions: Driving Change in Food & Agri This article is part of a series of short LinkedIn blogs by the Food & Agri team of Anders Invest. Here, we outline our perspectives on key themes that are relevant to the Food & Agri sector and explain how we try to make an impact with our portfolio companies and investment strategies. Considering reducing your carb intake? While some individuals vouch for its effectiveness, others view it as a passing trend in nutrition. In contrast, reducing carbon emissions is a shared objective that unites the global food system. Unless we minimize CO2, methane, and other greenhouse gas (GHG) emissions, sea levels will rise, and the likelihood of catastrophic weather events will increase, impacting the food and agricultural industry.This article will examine the carbon market and will focus on Origin & Amsterdam, a portfolio company of ours, known for its sustainable sourcing and trading. Food plays a crucial role in combating climate change, encompassing factors such as dietary choices, agricultural practices, and the supply chain that connects producers to consumers. Achieving the 1.5-degree target necessitates a reduction of global greenhouse gas emissions, with a goal of reaching a 50 per cent reduction from current levels by 2030 and attaining carbon neutrality by 2050. The framework to achieve these global targets in the food and agricultural industry is outlined in initiatives like the Green Deal. Consequently, the number of companies committed to reaching net-zero emissions has surged globally, with those taking action on such corporate targets quadrupling since 2020—from approximately 1,000 in 2020 to more than 4,000 in January 2023. In this transition towards a net-zero economy, the role of carbon offsetting will be crucial. The carbon market can take two different but not mutually exclusive paths: a compliance carbon market and a voluntary carbon market. In the European Union, the compliance carbon market operates under the EU Emissions Trading System (ETS), a cap-and-trade system designed to limit greenhouse gas emissions across the continent. Under the EU ETS, the European Commission sets an overall emissions cap, which represents the maximum allowable emissions within the EU's jurisdiction, covering key sectors such as power generation, manufacturing, and aviation. This cap is progressively reduced over time to align with the EU's climate targets. Companies receive or purchase emission allowances within this cap, and if they emit less than their allowance, they have the right to sell their surplus permits to others. The price of permits has experienced significant growth. In 2018, a permit was valued at €7.50, while by March 2023, it peaked at over €100. Therefore, this can be a powerful tool and mechanism to incentivize companies to innovate and reduce their emissions. On the other hand, a voluntary carbon market uses carbon credits: a document representing the equivalent of one metric ton of carbon dioxide and other greenhouse gases, either prevented from being emitted into the atmosphere (emissions avoidance/reduction) or extracted from the atmosphere through a carbon-reduction project. This market could lead to emission avoidance/reduction in the short term by investing in green energy, energy-saving technologies, and natural resources. Secondly, it can lead to emission removal (negative emissions). Achieving net-zero emissions by 2050 will require at least five gigatons of negative emissions annually. The voluntary and compliance carbon markets face challenges related to measurement, standardized rules and regulation, leakage, and uncertainty. However, there are promising opportunities to make an impact within the food and agricultural industry. Future developments may enable the financial compensation of sustainable practices, reforestation efforts, and carbon sequestration processes. Companies that lead the way with innovative and environmentally friendly approaches are more likely to benefit from these opportunities. Consequently, investing in companies that actively remove and reduce emissions aligns with our investment philosophy and strategy, making both financial and moral sense. Michel Beekwilder of Origin & Amsterdam, a company from our portfolio specializing in sustainable sourcing and B2B trading of organic products like wheat, spelt, sunflower seeds, soybeans, nuts and vegetable oils, explains what role the carbon market will play in his pursuit of a more sustainable enterprise: "Every organization, regardless of size, will soon need to adhere to forthcoming regulations on environmental impact. We've established benchmarks and performed an internal materiality analysis to remain proactive and not merely reactive. Given our rapid expansion and dependence on the emissions from our logistics partners, a mere commitment to reducing CO2 isn't adequate. Instead, we prioritize partnerships with entities that utilize renewable and hydrogen-based fuels. Our goal is a 30% reduction in average emissions from transport of our products over the next five years. Any gaps in achieving this will be addressed through carbon offset purchases." "Aligning with our mission to create a positive impact, this approach also presents a strong business case. By 2024, major corporations will be mandated to detail their impact via CSRD, tracing back through their value chain to illustrate the nature of the products they acquire and sell. Consequently, these corporations will likely collaborate with sourcing firms with comprehensive impact reports and lead the way in sustainable policy. Moreover, by investing a premium, they can endorse their items with a carbon-neutral label, enhancing their product's value. We expect that customers who strive for transparency and sustainability will want to work with us. This shift is already happening, and making the right strategic decisions now will enable Origin & Amsterdam to be future-proof and acquire plenty of new business."

30 november 2023

Innovation and Sustainability in Packaging: An Interview with Klaas Hoving of Horizon Natuurvoeding This article is part of a series of LinkedIn interviews by the Anders Invest Food & Agri team. In this series, we take a look at the people and activities within our portfolio companies. In this interview, we talk to Klaas Hoving, who works at Horizon Natuurvoeding. Horizon produces organic nut butters as well as packaged nuts and dried fruits. These products are sold throughout Europe in organic and specialty food stores under the brands: Horizon, Monki, Jori, and Krekeltje. Horizon is celebrating its 45th anniversary this year, and one of the ways they're marking this milestone is by launching a new packaging line. New Packaging Line Klaas Hoving has been working at Horizon as a Marketing & Benelux Sales specialist for about 11 years. Horizon is increasingly focusing on product innovations, with the most recent one being the revamped way of packaging organic nuts, seeds, and dried fruits. "With the new packaging line, we ensure that our products are even more visible on the shelves of organic and natural food stores and specialty shops. The nuts, seeds, and dried fruits will be packaged in quadroseal stand-up pouches in IJsselstein, improving their presentation." For Horizon, the new packaging is an improvement, and, as Klaas explains, the customers and retailers who were consulted about the stand-up pouches are very positive about them. Flexible and Dynamic Product Development In addition to making Horizon's products look better on the shelves and easier for consumers to find through the stand-up pouches, there are other benefits to the changed packaging line. Klaas mentions that while Horizon already imported and processed nuts, seeds, and fruits themselves, now they've added packaging to their capabilities. "We have more control over the production process, as we can now handle the packaging as well. This makes us much more dynamic and efficient in our product development." Moreover, the stand-up pouches offer opportunities to better serve customers and end-users in different countries. "The entire process, from bulk to the final packaged product, can now be handled by us. This allows us to provide a complete package, and in the long term, we see possibilities to better support our customers. This can also have pricing benefits for customers." Furthermore, the new line also provided a good reason to examine the packaging materials used and enhance their sustainability. Klaas explains that Horizon has opted for packaging made of 100% polypropylene, which is fully recyclable. The packages are then transported in cardboard boxes and sealed with cardboard tape, which is more sustainable than the plastic tape previously used. This way, Horizon ensures that their values are reflected in every step of the chain – from the final packaging that the consumer sees to the processes the product goes through. Challenges and Opportunities in Packaging Design While the flexibility gained by adjusting and taking control of the packaging has been a significant advantage for Horizon, it also required a lot of testing and experimentation. Klaas explains that the main challenge was aligning the product quantity with the size of the packaging. Horizon has been distinguishing itself for years by offering various packaging sizes, he says. Especially in the segment of small packages of organic nuts, seeds, and dried fruits, Horizon is unique: the quantities of 150, 400, and 800 grams are appealing to different target groups. "During the packaging testing, we didn't get the right ratio in one go: sometimes there was too little product in the stand-up pouch and too much packaging, and other times there was too much product. Not to mention fitting and arranging the consumer units in the right outer cartons and the ideal stacking ratio on the pallet. "Jeffrey and Raymon, as operators, are responsible for the packaging line and have worked incredibly hard in the past period. It's great to have dedicated employees with a lot of technical expertise," Klaas says. Ultimately, after several attempts, they succeeded in finding the right proportions for all the products offered in the stand-up pouches. However, Horizon is far from done with innovating, and it is precisely because of the packaging line that they see new possibilities, both within and outside the Netherlands. "With this packaging line, it's easier to innovate in products: for example, we can now offer mixed packages more easily, with different nuts, seeds, and dried fruits all in one," Klaas continues. "Additionally, we can expand more easily in countries outside the Netherlands. For instance, our Monki brand is already well-known for nut butters in a large part of Europe. In the future, we could introduce stand-up pouches with organic nuts, seeds, and dried fruits under that brand. This way, there's a trusted and beloved brand in those areas with a 'new' product line." Klaas then explains that they're always working on improving products and coming up with new concepts. "We will continue to do so. We are full of new ideas to develop and launch in the coming years. At the same time, Horizon remains timeless and uncompromising. We adhere to our ideals, and this makes us reliable. This personally appeals to me, and we see it reflected in the trust and appreciation we receive from our customers."

02 november 2023

Pioneering Sustainable Grain Trading: The Journey of Spartac Chilat and Prograin This article is part of a series of interviews by Anders Invest's Food & Agri team. Here, we look at people and activities from our portfolio companies. In this interview, we meet Spartac Chilat, the founder and CEO of Prograin Organic. A company that operates in the field of cultivation, processing, storage, trading and export of organic grains, seeds, and pulses in the Republic of Moldova. They were the first company to introduce organic food and agriculture in Moldova and help farmers transition from conventional to organic practices. History of Spartac and Prograin Spartac has been involved in the food and agriculture industry since graduating from the Academy of Economic Studies of Moldova in 1997. Throughout his career, he held several positions with agricultural companies; focusing on the distribution, logistics, and trading soybeans, fertilizers, and grains across Moldova. What truly captivated him was the concept of uniting farmers and integrating them into a cooperative network. Leveraging his industry knowledge and network of distribution partners, buyers, and farmers, Spartac identified a promising opportunity in the grain trading industry in 2012, leading to the establishment of Prograin. Together with four former colleagues, he started his new venture. Having an in-depth understanding of conventional farming, Spartac was aware of its flaws. Fueled by a conviction to harness the full potential of Moldova's fertile landscape, he observed that ordinary operators lacked respectful land treatment, leading to reduced long-term fertility. The increasing use of chemicals and fertilizers deteriorated the ground and raised concerns about public health. Furthermore, competing in conventional farming against larger operators who used cost-leadership strategies posed obstacles with low margins, often undermining and eliminating smaller players. Therefore, Spartac recognized to take a more holistic view and initiated a transition to organic production in 2015 with Prograin. During this time, he met Dirk and Michel, his first Dutch connections, who were crucial in establishing the foundation for a later partnership with Anders Invest. "Prograin is deeply committed to aiding farmers by providing input supplies, certification, technological support, grain handling, logistics, legal assistance, and other essential activities. These endeavours, although crucial, require upfront investments. A significant challenge to note is that 80% of farmers struggle to make these initial investments without a direct return. This calls for a shift in mindset. Due to the sustainability aspect of our business, it's crucial to transition from short-term thinking to a long-term approach. While an investment today might take longer to realize profitability compared to conventional farming, with patience and understanding, it will ultimately become highly lucrative. This is not just due to enhanced soil health but also because of the opportunity for premium pricing. For a truly sustainable future, collaboration is vital. As we've always believed, "You cannot be sustainable if your partners are not sustainable." Together, with a united vision, we can ensure that both the land and our farming partners thrive." Anders Invest saw this niche market's favourable business climate and high growth potential in Moldova. Spartac explains: "Anders Invest brings their extensive expertise in food and agriculture, along with a long-term vision. We knew this was the perfect opportunity to start making a difference within the industry." Unique Value proposition of Prograin Prograin operates throughout Moldova's entire value chain of organic grains, seeds, and pulses. "We are dedicated to supplying high-quality organic products with complete traceability, ensuring a seamless journey from the field to the consumer's plate." Prograin ensures efficient collection and storage logistics and has invested in state-of-the-art organic processing lines. This commitment to infrastructure development allows Prograin to access organic grain markets effectively. They are Moldova's first IFS (International Featured Standards) certified company. Prograin's commitment to quality control ensures that products meet rigorous standards before export. They promote various crops, including spelt, wheat, oat, sunflower, corn, sorghum, mustard, green pea, yellow pea, soybean, rye, beans, alfalfa, and buckwheat. On top of that, they started the Moldova Organic Value Chain Alliance (MOVCA). An NGO that supports the growth and success of organic agriculture throughout Moldova and actively advocates for subsidies and pro-organic policies with the government. A bright future ahead The future of Prograin appears promising as organic production gains importance in the agricultural landscape. Spartac envisions significant growth driven by crop rotation, regenerative farming, and subsidies for green initiatives. The company invests in soil fertility programs to boost yields and increase profitability. Growth rates of more than 10% per year are anticipated as Prograin continues to navigate and excel in these different facets of the business. In conclusion, Spartac Chilat's journey in the food and agriculture industry has culminated in the establishment of Prograin, a pioneering force in Moldova's agricultural landscape. His vision of becoming a market leader and fostering a cooperative network among farmers has driven Prograin's success and has only just started. With the strategic partnership with Anders Invest, Prograin has a bright future, aiming to expand its reach and connect with more farmers while ensuring high-quality products and complete traceability from field to plate.

21 september 2023

Green Growth: Strengthening Organic Agriculture with Regenerative Practices for a Sustainable Future This is the first of a series of short blogs by the Food & Agri team of Anders Invest. Here, we outline our perspectives on key themes that are relevant to the Food & Agri sector and explain how we try to make an impact with our portfolio companies and investment strategies. Climate change presents challenges to humankind, with a variety of notable impacts across the globe, such as receding ice caps and severe weather occurrences. Food and agriculture have the potential to contribute positively to climate change mitigation. As stated by the UN, approximately 40% of the Earth's land is currently degraded, with the possibility of depleting our topsoil in around 60 years. In this Blog we investigate the potential of regenerative and organic farming to combat the adverse climate effects of agriculture and how we try to implement this at our portfolio company in Moldova: Prograin Organic. Organic and regenerative farming are both sustainable farming methods that have the potential to complement each other for even greater sustainable benefits. Regenerative agriculture is gaining momentum in recent years; by focusing on restoring soil health, enhancing biodiversity, and sequestering carbon, it aims to create a resilient and productive agricultural system. However, regenerative agriculture currently lacks universal definitions, practices, regulation, and supervision to have a consistent impact. Organic agriculture, through a certification system, does have universal definitions, practices, regulation, and supervision. However, it is relatively narrower than regenerative farming as it primarily focuses on avoiding synthetic chemicals and promoting natural inputs. We aim to combine the best of both worlds; that organic farming can be complemented with regenerative farming practices, specifically focusing on promoting the regenerative properties of soil. “At Anders Invest, we endorse organic as a dependable sustainability standard, while striving to surpass it by promoting regenerative practices in our portfolio companies. For instance, our Moldovan company, Prograin Organic, assists conventional farmers in transitioning to sustainable farming methods by providing organic fertilizers that boost soil regeneration. We pursue this approach not only to generate a positive impact but also to secure long-term financial returns through increased yields and improved crop quality” comments Jurjen van der Werf (Investment Manager at Anders Invest).

20 july 2023

Feeding the World: A Perspective on Sustainable and Affordable Food This article is part of a series of short blogs by the Food & Agri team of Anders Invest. Here, we outline our perspectives on key themes that are relevant to the Food & Agri sector and explain how we try to make an impact with our portfolio companies and investment strategies. As the world's population inches closer to 10 billion, the escalating food demand is unignorable. To meet this, global food production must ramp up by 50-70%, a challenge intensified by the 2.3 billion individuals already grappling with food insecurity. In addition, there is the simultaneous necessity to mitigate climate change impacts, underscoring the dual challenge of affordability and sustainability that more and more defines the food and agricultural sector. The challenge is that we’re trying to feed the growing world population while also needing to take care of our climate and all the different kinds of life on our planet. This situation has led to two different ways of thinking: agroecology and ecomodernism. Agroecology supports sustainable food production, leaning towards organic farming that takes care of the soil, clean water, biodiversity, and nutritious food. On the other hand, ecomodernism focuses on using technology and producing a lot of food on a small piece of land, suggesting a strict separation between farmland and other ecosystems where nature can flourish. Strike the right balance between satisfying the imperative demand for accessible food and tackling the pressing issue of climate change, and you'll find yourself caught in the midst of a high-stakes struggle. Volkert Engelsman, the founder of Eosta BV / Nature & More, simplifies this complex dilemma: “We are losing 30 soccer fields of fertile land every minute, profit can only be profit if it doesn’t jeopardize people and planet. While affordability is undeniably vital, it is equally important that we conduct comprehensive calculations that account for both the positive and negative externalities associated with nutritious food, social inclusion, and ecosystems.” Nevertheless, Hidde Boersma, in his thought-provoking piece for the Correspondent, sheds light on the ecomodernist view: “Through the adoption of intensified farming techniques, we possess the capacity to free up farmland spanning the entirety of Russia. This staggering feat can be achieved by harnessing the power of a 25% boost in crop productivity.” Boersma passionately argues that this preserved land, no longer under the plow, could be transformed into thriving natural ecosystems, becoming havens of biodiversity and environmental balance. However, Boersma's ideas regarding factory farming rest upon a set of assumptions that blur our understanding of ecosystems and microbiomes, misrepresenting their true workings. An oversimplification of nature allows for easy commodification and scalability but diminishes the intertwined complexities that constitute as nutritious food utilizing only a fraction of the required DNA of plants and neglects the importance of sunlight and instead using LED lighting. At Anders Invest Food & Agri Fonds, we understand that a one-sided approach risks overlooking the intertwined complexities of social development and environmental sustainability. In the short-term, there is a contention that a solely organic system lacks affordability for all, without taking into account negative externalities such as the increasing healthcare costs associated with food-related diseases, water pollution, and nitrogen intensification. Conversely, an excessive focus on agricultural intensification disregards environmental considerations, biodiversity depletion, water pollution, and the potential dependency of developing countries on western technology. As we analyze the crux of the matter, a distinct pattern comes into focus. It becomes increasingly apparent that the organic system exhibits minimal to no yield loss for fruits, while grains suffer a more substantial decline. Considering this significant revelation, we propose a focused strategy: let us channel our efforts into cultivating fruits using entirely organic methods, effectively demonstrating the positive impact on consumer prices while the lower yields justify a slight premium for the grains. After all, to provide affordable and organic sustenance for our rapidly growing global population, it is imperative that we address the global power dynamics within the food and agriculture sector. This involves reducing the substantial portion of land currently allocated to animal production, which currently stands at 70%, and prioritizing the availability of nutritious food worldwide. We will dive into these subjects in a later blog. Stay tuned!

20 july 2023

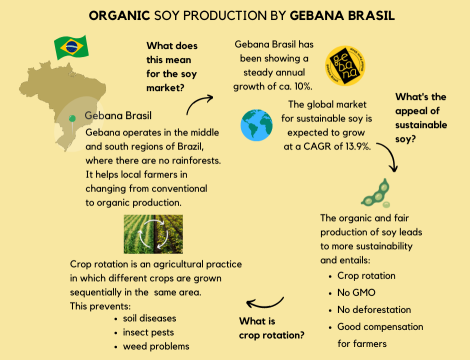

Sustainable Soy: Balancing Demand and Environmental Responsibility This article is part of a series of short blogs by the Food & Agri team of Anders Invest. Here we outline our perspectives on key themes that are relevant to the Food & Agri sector and explain how we try to make an impact with our portfolio companies and investment strategies. The popularity of soy-based products has been steadily increasing for years. Soy is a versatile legume that is used not only as a meat substitute in products like veggie burgers and vegan chicken, but also as a source of protein for livestock and farmed fish. A big part of the soy production occurs in Brazil, Argentina, and the United States, where the favourable climate allows for high crop yields. Within Europe, the Netherlands is the largest importer of soy, importing 2.51% of all soy, worth 2.19 billion dollars. Thus, soy is big business in our country! The cultivation of soy, however, has a dark side which can be most clearly seen in Brazil and is caused by three things mostly. Firstly, vast forest areas have been cleared to make way for soy fields, resulting in a significant loss of biological CO2 sequestration. This has detrimental consequences for global warming and biodiversity, as the rainforest is needed to reduce CO2 in the environment and houses a large variety of flora and fauna. Secondly, the use of pesticides and imported fertilizers in soy cultivation has raised concerns about environmental sustainability, as because it can lead to water pollution, for example in rivers and lakes surrounding the soy fields. Lastly, instances are known where farmers producing soy have been exploited and pushed excessively to get the most out of their land. Apart from this, local tribes that rely on the rainforest are being threatened in their survival. Since the Netherlands plays a big role in import and export of soy, this also comes with a responsibility to make sure the soy is of good quality and not a product of harmful malpractice to nature or the local population. The good news is that there are local initiatives that see these problems and that strive to produce soy in an environmentally friendly way, while also taking into consideration the wellbeing of farmers producing the crop. One of the companies taking initiative is Gebana Brasil, one of our portfolio companies at Anders Invest. They are contributing by promoting and processing organic, non-genetically modified soy and other grains and seeds, as well as fair compensation for farmers. Saskia Korink, investment director for Anders Invest, explains the approach of Gebana further: “Organic soy production also entails crop rotation. This means that a different crop is growing on a particular piece of land each growing season. This is very useful to prevent soil diseases, insect pests, weed problems and to build healthy soils." To drive significant change in the sustainability and ethics behind soy cultivation, it is important to look beyond well-known institutions like legislators and policy makers and support local endeavours that bring about tangible impact, mitigate deforestation, and pave the way for a genuinely sustainable future.

20 july 2023