Anders Invest Rental Housing Fund

Locations Invest Yield Participation exemption Involved

We invest in Dutch rental properties for the long term, where we attach great importance to social cohesion between our tenants. We invest with our own resources and with money entrusted to us by third parties in existing homes, renovation, transformation and new construction projects. We use our real estate expertise to increase tenant satisfaction and an attractive return for our investors. We operate flexibly in different market conditions so that we benefit from real estate cycles and achieve solid returns over the long term.

Invest

Investors can join the fund on new capital rounds. Depending on the number of investment opportunities, we organize a capital round once or twice a year in which existing and new investors can invest in the fund. The initial investment is at least €100,000. You become a member of a cooperative, a common and fiscally attractive legal form for funds. You always fall within the participation exemption, even with a small interest. Exit is in principle done by selling the membership rights to another investor. Anders Invest supports this process and therefore does not have to sell companies or properties.

Yield

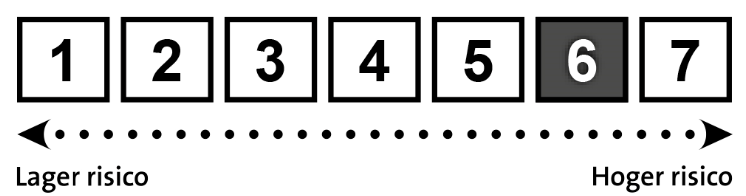

We expect a good return, consisting of dividends and an increase in value, at a manageable risk. The rental income is paid to the investor twice a year after deduction of costs, repayment and tax. This already yields an expected return of 2.0 to 3.5% per year. The value development arises partly from repayment on bank financing and rent indexation. With unchanged market conditions an annual return of 5,5% is possible, but circumstances do not remain the same. Market prices can go up, but the market will also go down again. We want to take advantage of this with a flexible buying and selling policy. And selling a (large) part of the portfolio with a premium is one of the possibilities.

As of 25 September 2025, Anders Invest Fondsbeheer has an AIFMD licence to offer and manage investment institutions in the Netherlands (Article 2:65, opening words and under a, Wft).

Past performance is no guarantee of future results.

Participation exemption

The Anders Invest Rental Properties Fund is a cooperative. Thanks to this legal form, the participation exemption also applies to interests under 5% in our current tax regime when participating with a BV. The risks are manageable by focusing on a segment with few vacancy risks, current properties and realistic financing.

Involved

We like to involve investors in proposed projects. In this way we like to make optimal use of all knowledge and networks. We only make new investments with money that has already been committed. In other words: after the investor's mandate. When a property or part of the portfolio is sold, we distribute the net profit (a super dividend) to investors.

I am looking for an investor for my object