Sustainable Soy: Balancing Demand and Environmental Responsibility

This article is part of a series of short blogs by the Food & Agri team of Anders Invest. Here we outline our perspectives on key themes that are relevant to the Food & Agri sector and explain how we try to make an impact with our portfolio companies and investment strategies.

The popularity of soy-based products has been steadily increasing for years. Soy is a versatile legume that is used not only as a meat substitute in products like veggie burgers and vegan chicken, but also as a source of protein for livestock and farmed fish. A big part of the soy production occurs in Brazil, Argentina, and the United States, where the favourable climate allows for high crop yields. Within Europe, the Netherlands is the largest importer of soy, importing 2.51% of all soy, worth 2.19 billion dollars. Thus, soy is big business in our country!

The cultivation of soy, however, has a dark side which can be most clearly seen in Brazil and is caused by three things mostly. Firstly, vast forest areas have been cleared to make way for soy fields, resulting in a significant loss of biological CO2 sequestration. This has detrimental consequences for global warming and biodiversity, as the rainforest is needed to reduce CO2 in the environment and houses a large variety of flora and fauna. Secondly, the use of pesticides and imported fertilizers in soy cultivation has raised concerns about environmental sustainability, as because it can lead to water pollution, for example in rivers and lakes surrounding the soy fields. Lastly, instances are known where farmers producing soy have been exploited and pushed excessively to get the most out of their land. Apart from this, local tribes that rely on the rainforest are being threatened in their survival. Since the Netherlands plays a big role in import and export of soy, this also comes with a responsibility to make sure the soy is of good quality and not a product of harmful malpractice to nature or the local population.

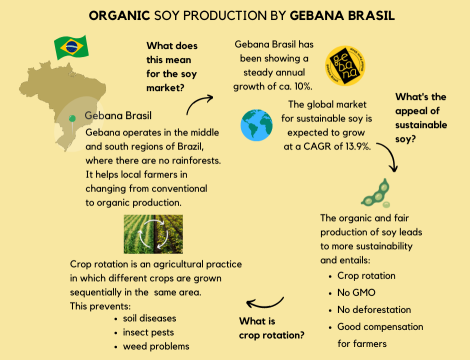

The good news is that there are local initiatives that see these problems and that strive to produce soy in an environmentally friendly way, while also taking into consideration the wellbeing of farmers producing the crop. One of the companies taking initiative is Gebana Brasil, one of our portfolio companies at Anders Invest. They are contributing by promoting and processing organic, non-genetically modified soy and other grains and seeds, as well as fair compensation for farmers.

Saskia Korink, investment director for Anders Invest, explains the approach of Gebana further: “Organic soy production also entails crop rotation. This means that a different crop is growing on a particular piece of land each growing season. This is very useful to prevent soil diseases, insect pests, weed problems and to build healthy soils."

To drive significant change in the sustainability and ethics behind soy cultivation, it is important to look beyond well-known institutions like legislators and policy makers and support local endeavours that bring about tangible impact, mitigate deforestation, and pave the way for a genuinely sustainable future.